Note: I will take the next week off. Thus, there will be no posts until 18 June. In the meantime I will post a video interview tomorrow I did with the CFA Institute recently where I talk about the world after Covid. See you all again on the 18 June.

And now on to today’s thought…

As some of my readers know, I wasn’t always a banker. I trained as a mathematician and physicist with a focus on theoretical astrophysics and particle physics (Keep your Big Bang Theory jokes coming). When I read an interview with Lulu Miller about her new book Why Fish don’t Exist, I was reminded of my astrophysics roots and what it can teach us about investing and life in general.

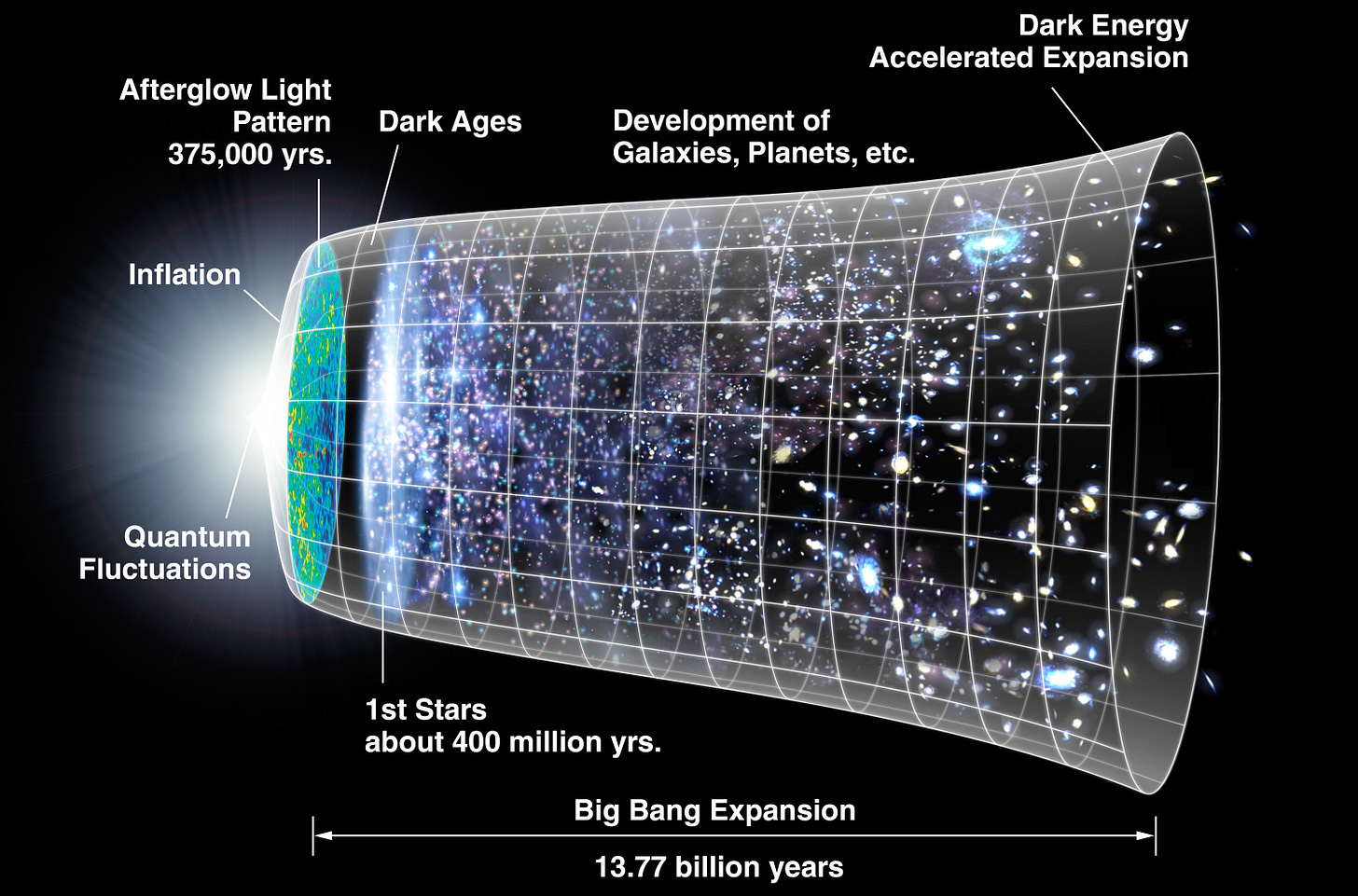

If you study the universe, one of the things you learn is that it is a place where order and chaos are constantly in conflict with each other (aka the Second Law of Thermodynamics). Ever since the Big Bang, the universe is growing bigger and bigger and the energy contained in it is driving matter and energy apart in a pretty random and chaotic fashion. At the same time, you have the four fundamental forces of nature[1] that lead to islands of order and regularity in it (gravity, for example, is the driving force behind the creation of galaxies, stars, and planets). The chaos of the universe is needed to create new structures. And islands of order like a star and its planetary system eventually disintegrate into chaos out of which new structures are created. A wonderful symbol for this order out of chaos is the fact that on Neptune, the atmosphere is so volatile and chaotic and the pressure is high enough, that scientists suspect it sometimes rains diamonds on it.

In financial markets (and in life) we see the same struggle between order and chaos. For the last decade, financial markets have been relatively calm and orderly places and prices went up with little disruption. And then, this virus comes along and turns everything upside down. Our daily lives have been thrown into chaos as we had to live with our children under one roof for 24 hours a day and no way to send them off to school and get a break. Similarly, businesses that were doing just fine a few months ago, all of a sudden face existential crises.

It would be very surprising to me if this crisis would not lead to the demise of some prominent businesses in the next few years – possibly even some with decades or a century of business success. But this chaos is not going to be only destructive. Out of this chaos will emerge new businesses and some businesses will not only thrive during the crisis but become the winners of the future. The seeds of the next Amazon are sown in this crisis. The challenge for investors is to survive the current chaos and identify the winners that will emerge out of it soon enough.

How can this be done?

To survive this crisis, businesses need to have a solid balance sheet, sufficient liquidity, and not too much debt. And investors should focus on these quality companies as a way to identify investments with limited downside risks.

To identify the winners of the new world order after the crisis is much more difficult. The business model of the company will be a major success factor, but so will be sufficient capacity to finance growth, a differentiated product or service offering, convenience for customers, and the always elusive x-factor that makes customers choose company A over its competitors. This is why growth investing is so difficult. There are so many unpredictable and unmeasurable factors involved that it is extremely hard to separate the winners from the also-ran and the losers. A simple passive way to identify the winners of the new world order is to let the market guide you and just go with price momentum as the driving force behind your investment decisions.

And what about value investing?

The main challenge for value investors is to get a good idea of the fair value of an investment. But in the world after this crisis is over, some businesses may never get back to the same earnings level as before the crisis. And valuations may never recover to historic averages. In the next few years, successful value investing will become much more difficult because investors either restrict themselves to massive margins of safety (and thus limit their investment opportunity set to a handful of stocks) or they accept a lower margin of safety and risk accumulating value traps.

[1] Or three if you think of the electroweak force as one force…, or two if we develop a proven Grand Unified Theory…, or one if you believe we will find the Theory of Everything…, ah forget it…

Buy a World Index Tracker Fund!