Leaking like a sieve

It is Fed Day (again) and investors around the globe are eagerly expecting the decision and forward guidance on interest rates. Is today the day when the Fed will cut interest rates or will they wait some more? You can be sure that there have been lots of rumours going round in recent days (I don’t know because I write these lines several weeks in advance). But should you pay attention to such rumours? Research by the ECB indicates that rumours and leaks may better be ignored.

The research carefully sifted through news reports by Reuters, Bloomberg, and Market News International to look for leaks by people working in the ECB or its affiliated central banks in the days before a rate decision. Between 2002 and 2022 they found a total of 1,253 news items reporting on 368 unique leaks by anonymous insiders. In other words, the ECB is leaky like a sieve. Here are a couple of examples on how these leaks look like:

Market News International on 28 January 2014: “ECB SOURCES: NEG[ATIVE] DEPOSIT RATE ’ACADEMIC DISCUSSION’ AT PRESENT”

Reuters on 21 October 2014: “EXCLUSIVE-ECB looking at corporate bond buys, could move as soon as Dec - sources”. The European Central Bank is considering buying corporate bonds on the secondary market and may decide on the matter as soon as December with a view to begin buying early next year, several sources familiar with the situation told Reuters. The ECB has already carried out work on such purchases, which would widen out the private-sector asset-buying programme it began on Monday – stimulus it is deploying to try to foster lending to businesses and thereby support the euro zone economy. “The pressure in this direction is high,” said one person familiar with the work inside the ECB, speaking on condition of anonymity. [...]

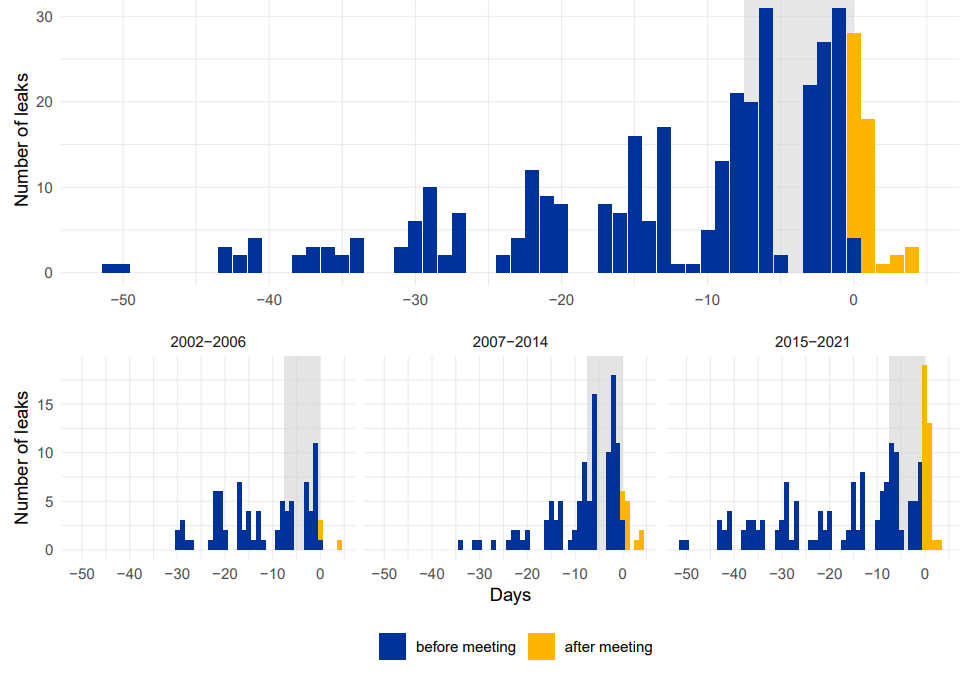

If you look at the timing of these news reports they tend to become more frequent in the days just before a policy meeting, as one could expect since that is when more and more people become involved in the prep work for the meetings and the discussions around the different policy options.

Timing of leaks around ECB policy meetings

Source: Ehrmann et al. (2023)

These leaks tend to move markets as traders try to position themselves ahead of the official announcement. But ironically, these leaks tend to go in the opposite direction of the official decision and statements by ECB officials tend to mitigate the market impact of these leaks.

In other words, these leaks are not ‘plants’ by the ECB to prepare the market for upcoming rate decisions. Rather, it seems likely that these leaks are planted by insiders who disagree with the majority opinion among policy makers and want to put pressure on policy makers to change their decision. But these efforts to influence the ECB decision seem to fail as the research shows no impact of leaks on the decisions taken.

So, when you hear rumours about the upcoming policy decision by the ECB or the Fed or any other central bank, you should proceed with caution. More likely than not they are the views of minorities and outsiders among policy makers, and you will get caught wrong-footed when you trade based on these leaks.