Tax evasion is bad. Everybody, companies and individuals alike, should pay their fair share in taxes and if they don’t the government should go after them to enforce compliance. If we allow businesses and individuals to evade taxes, the government and all of us will lose out because there will be lower tax revenues and increased pressure on the government to increase taxes on honest taxpayers to make up for the shortfall. Or do we?

There is a theoretical argument that tax evasion may not be so bad for the government and the economy after all. If people are able to cheat on their taxes and avoid paying them, they might work more because the additional income goes straight into their pockets. And that increase in work adds to GDP, which in turn increases employment, which in turn increases tax revenues. If the increase in labour supply offsets the losses from tax evasion, the government in the end may be better off letting people cheat on taxes than enforcing 100% compliance.

That’s the theory, but how do things work out in real life? Wladislaw Mill and Cornelius Schneider from the University of Mannheim set up a mini economy with 1,000 participants on Amazon MTurk. They asked the volunteers to count the zeros in tables with 150 randomly allocated zeros and ones. This task is obviously tedious and pointless, so very much ‘work’, in the sense that it requires effort to do. For each table, the participants got paid $0.12 and the participants had to commit to working through a certain number of tables before they were given the job. The participants could choose freely how many tables they were willing to work on, but once they had committed, they had to go through with the work. The money the participants made was taxed at income tax rates of 20%, 40%, 60% or 80%.

And here is the twist. Some participants had to pay the tax on the income they generated from their work, while others could put part of their income in a lottery where they had a 50% chance of not being taxed at all and a 50% chance of being audited. If they were audited, they had to pay the owed taxes and a 20% penalty on that untaxed income. Again, the participants were free to choose, how much of their income they would try to evade from the tax man.

What happens is illustrative. The first chart shows the labour supply in the market with and without the possibility of evading taxes. If people could put some of their income off the books and try to hide it from being taxed, labour supply (the number of tables they were willing to work on) increased on average by 37%.

Labour supply increases if people can avoid paying taxes on additional income

Source: Mill and Schneider (2023)

Interestingly, while participants were willing to work 37% more if they could evade taxes, they would on average try to avoid paying taxes on some 40%-50% of their income. Essentially, they would on average want to pay taxes on the same amount of work they did in a situation where they could not evade taxes but keep the additional work off the books.

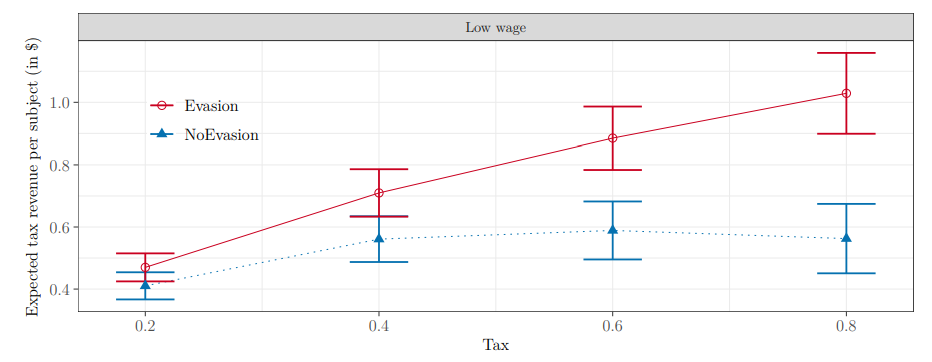

Of course, people can try to evade taxes but there is a 50% chance of being caught, in which case they have to pay back taxes and a penalty. The result is that on an aggregate basis, the government gets higher tax revenues when people are allowed to cheat on their taxes than when they know they will not be able to evade taxes. The effect is so large that a fully enforced 40% marginal tax rate could be replaced by an effective tax rate of 28% with the option of tax evasion without any loss of tax revenue for governments.

Government tax revenue can increase if people are able to cheat on their taxes

Source: Mill and Schneider (2023)

Obviously, it is impossible for the government to say, “Feel free to evade taxes as long as you pay them on some of your income”. That is absurd. But what governments can do and indeed do all the time is provide tax loopholes that allow businesses and individuals to shelter some of their income from taxes or tax them at much lower rates. In particular, businesses have come under heavy criticism for doing that. But what this research shows that in real life, allowing businesses to take advantage of these loopholes may increase the total tax revenue generated by the government because businesses (and individuals) simply work more and offer more income-generating products and services than they would if they weren’t able to shelter some of their revenues from taxation.

Something to think about for the advocates of crackdowns against corporations that optimise their taxes.

Reminds me of the laffer curve, but can macro conclusions really be drawn from micro preferences? Also transfer mispricing and other creative accounting can shift significant foreign currency out of entire countries.

I expect that part of the improvment is due to the chance of ebing caught. If this is lower than 50%, i.e. the governmetn is less efficient in discover tax evasion, the trade off is worse