The One Big Beautiful Bill Act (OBBBA) is making its way through the Senate and – if the government can overcome the resistance from a growing number of Senators – will become law in July. The headline-grabbing number was the estimate by the Congressional Budget Office that if passed in its current form, it will add $2.4 trillion in deficits over the next ten years. However, we are in the midst of the investor community losing confidence in the US government and demanding higher risk premiums on Treasuries. This could accelerate the rise in long-term Treasury yields.

If even Jamie Dimon publicly warns of the bond market cracking, we should pay attention. After all, Dimon is the CEO of America’s largest lender, and he has a lot to lose if he stokes an unwarranted panic in the bond market. So, he typically chooses his words carefully not to spook the markets.

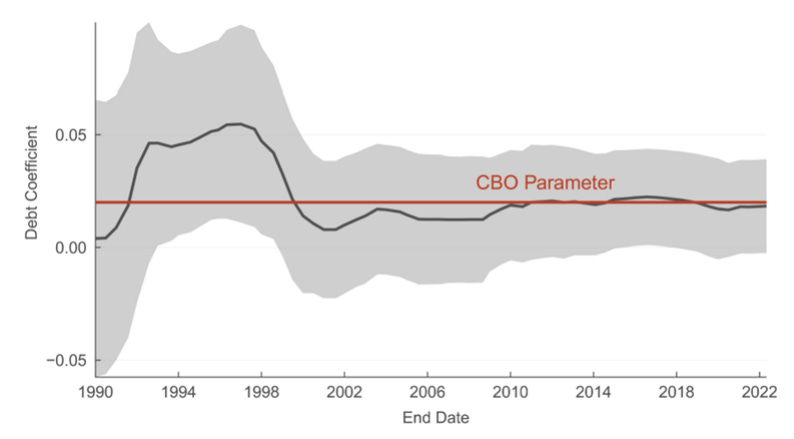

While the projected deficit increase is grabbing the headlines, I want to point out that the Congressional Budget Office also recently estimated how higher debt translates into higher interest costs and higher Treasury yields. The chart below is the main result from their analysis. It shows by how much long-term Treasury yields rise in the long run for every percentage point increase in the US debt burden. Over the last 20 years or so, the relationship has been remarkably stable at roughly 2bps per one percentage point increase in US debt-to-GDP.

Debt sensitivity of Treasury yields

Source: Neveu and Schafer (2024)

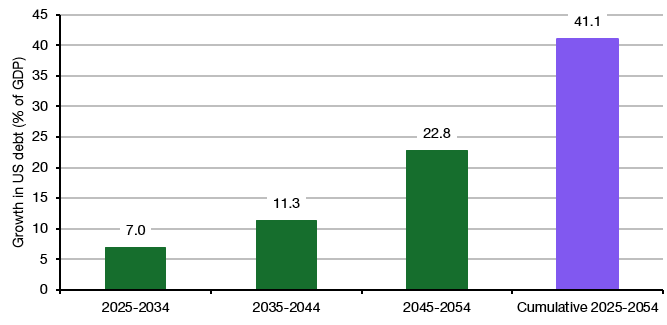

Using a similar relationship, the Yale Budget Lab has recently calculated that the combined effect of higher deficits plus higher interest costs from rising Treasury yields will erode GDP growth and increase the US debt-to-GDP ratio by seven percentage points over the coming decade.

But that is only the beginning, because as Albert Einstein already knew, compound interest is the eighth wonder of the world, and what starts as a relatively easy-to-digest increase in US debt-to-GDP very quickly spirals out of control. The Yale Budget Lab estimates that the US debt-to-GDP ratio will increase by 41.1 percentage points over the next 30 years due to this one bill, and US Treasury yields will rise by about 120 basis points.

Increase in US debt as share of GDP to 2054

Source: Yale Budget Lab

In these posts, I have been going on about rising US yields for a year now. What has started as an outside opinion a year ago has become a mainstream talking point, but I think most investors still don’t realise how close the USS is to a meltdown in Treasury markets. The results above are changes in Treasury yields over the next thirty years, but the problem is that markets don’t adjust gradually over the years. They don’t adjust at all for a long time, and then panic and overshoot rapidly. Or as Rudiger Dornbusch has put it: “In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could”.

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

-- Ernest Hemingway, The Sun Also Rises, 1926

Sounds like we’re riding a financial rollercoaster with this debt stuff—better hold on tight before the crash. Gotta keep an eye on those yields.