The rise of passive investing brings with it the counterargument by active managers that markets are getting less efficient as fewer and fewer investors are trading based on new information. Meanwhile, passive investors reply to that challenge that the rise of HFT and other investors who react very quickly to new information should lead to more efficient markets. Besides, passive funds account for only about half the market so there are plenty of active managers around to keep markets efficient.

About two years ago, I wrote about a study that showed that large cap stock markets seem to have become more efficient since much of the attention of the media and investors is focused on these stocks. Meanwhile, smaller stocks and less glamourous stocks seem to show less efficient pricing as information is incorporated into the price more slowly.

Now, Valentin Haddad from UCLA and his colleagues took a different approach to measuring market efficiency. They built a model that measures the price elasticity of share prices to changes in demand and supply and then split the price elasticity into different components. The idea is that finance models assume an efficient market in the sense that share prices are highly elastic to changes in supply and demand, thus incorporating changes in investor views very quickly. The less elastic prices are to changes in supply and demand the more inefficient a market becomes since new information is incorporated only slowly into the price.

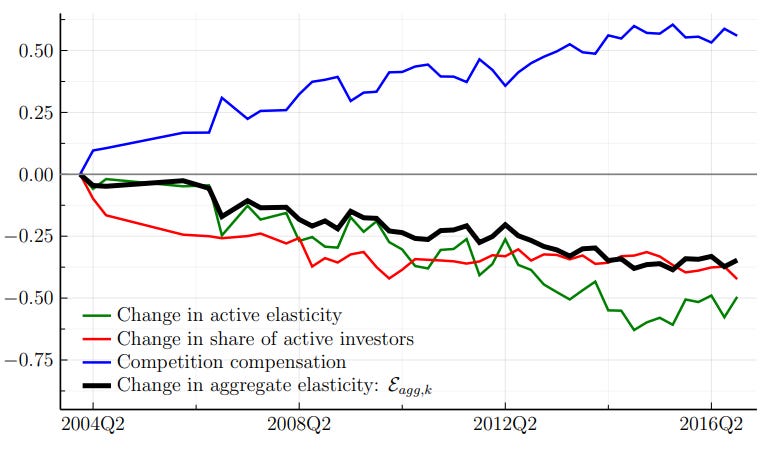

As usual, models have to be taken with a lot of caution, but the chart below shows the change in price elasticity in the US stock market between 2004 and 2016. The green line shows the change in active elasticity, i.e. the change in how elastic the demand and supply of active managers change to new information. A decline like the one shown in the chart indicates that active managers on average have become less reactive to prices and reduced share price elasticity by about 50% between 2004 and 2016.

The red line in the chart below shows the effect of the rise of passive investment vehicles on the market. Because passive investors don’t care about new information, they make share prices more inelastic. The fact that active managers have lost market share to passive investors reduced share price elasticity by another 35%.

Finally, the blue line shows the reaction of the market overall to the changes in elasticity caused by the previous two factors. It is hard to say what flows into this blue line, but in my view, a key component is the rise of HFT and other investors that systematically take advantage of market inefficiencies like post earnings announcement drifts, etc. the combined impact of these factors is an increase in share price elasticity of about 50%.

The net effect, however, is clear. Markets are becoming less efficient over time and share price elasticities to new information have on average declined by some 30%. The impact is much less for large cap stocks since the study also shows that the largest stocks have share prices that are essentially perfectly elastic. It’s once again the small- and mid-cap space where markets are becoming less efficient.

Change in share price elasticity in the US 2004 to 2016

Source: Haddad et al. (2021)

wow, another great post.....