I am a member of GenX and thus, I have always felt like I am joining a demographic party that ended several years ago. Because I am part of the smaller cohorts born in the 1970s, the baby boomer generation will not only have retired before me but essentially gorged on the welfare system from social security to healthcare. Meanwhile, the declining labour force population means that we have to pay more and more to finance the creaking social welfare net while also having to save more for our own retirement due to the abolition of defined benefit pension schemes that guarantee a pension.

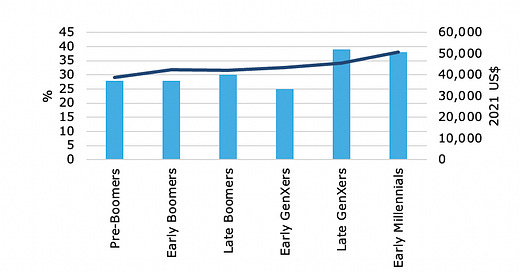

The likelihood of a GenXer living off less than 75% of her pre-retirement income during retirement is 35% to 39% compared to 28% to 30% for Boomers. At least we GenXers can share our misery with Millennials, according to a new study by Karen Smith and Richard Johnson from the Urban Institute. They showed that Millennials are essentially in the same boat as GenXers. While their expected household income at age 70 is higher than that of Boomers or GenXers (when adjusted for inflation), they also face higher costs for healthcare and eldercare services that are not paid for by the US healthcare system. And yes, this is a study of the US system. In other countries, the outcomes might differ significantly depending on the setup of the healthcare and social welfare system.

In any case, some 38% of early Millennials are at risk of having inadequate income at age 70 (defined as either less than 75% of pre-retirement income or being in the bottom 25% of the country in terms of household income). That’s comparable to the 39% for late GenXers and a little higher than the 35% for early GenXers. Note also that this estimate assumes that social security will continue to pay benefits in full. If social security payments are cut by 25%, the share of Millennials with inadequate income at age 70 will rise to 48%.

There are quite a few things that are in favour of Millennials making more money in retirement, not the least of which is that they will get a better demographic hand to play since there are more Millennials than GenXers and that means that more people will pay for the pensions of retired GenXers, creating a declining dependency ratio, But none of that will be enough to overcome the strains on the existing social welfare net in the US. Millennials will join us GenXers in coming to a party some 20 years after it was over.

Risk of inadequate income at age 70 by cohort

Source: Smith and Johnson (2022)

Great post! In the British context, out of interest, what are your thoughts are on the triple lock?