MMT and inflation

The more I read about Modern Monetary Theory (MMT) the more I think it should be renamed to “Ahistoric Monetary Theory”. It seems to me that advocates of MMT are either ignorant of historic precedent or think that economists today are so much better at forecasting inflation and regulating business than in the past that it borders on delusion.

For those new to MMT, I have written a brief introduction that is available here . The basic idea of MMT is that governments that control their own currency have much bigger leeway in running deficits than previously thought. This does not mean that deficits don’t matter as some critics of MMT claim, but that deficits in fact only matter in some circumstances. MMT advocates argue that most of the time, rising deficits equate to rising wealth of the citizens. This view originates in the observation that government deficits are financed by government bills and bonds, which in turn are accounted for in private sector balance sheets as assets.

Proponents of MMT argue that we should run massive deficits to create full employment and transform the economy to reduce greenhouse gas emissions and fight climate change. To be sure, I have a lot of sympathy for increasing deficits in order to invest in infrastructure that will help us fight climate change. Unlike deficits run to finance tax reductions for corporations and individuals as was done in the US, such investments have a much bigger impact on future growth.

However, a recent letter published in FT Alphaville by three MMT proponents really worried me. In the letter, the authors argued that the existing budget constraint in fiscal policy should be replaced with an inflation constraint, i.e. fiscal policy instead of monetary policy should ensure that inflation does not increase above certain levels. Let’s not argue about whether the US and UK have already tried to do that in the era of Keynesian policy during the 1960s and 1970s and instead look at their examples. First, they argue – and I agree with that assertion – that inflation can have many different causes.

One cause of inflation can be excess demand when the economy is operating at full capacity. In that case you would expect employers to be forced to pay higher wages to find qualified workers, which in turn creates wage inflation and finally price inflation. This is essentially what happened in the 1970s and the way to counteract this wage-price spiral is to hike interest rates dramatically or increase taxes to curb demand.

But the authors also argue that businesses raising profit margins or Wall Street speculating on commodities create inflation as well. In this case, the authors argue, government should regulate business pricing power (e.g. through price controls), tighten financial and credit regulations to curb bank lending and fight speculative activities in the markets. If these economists had read up on the history of price controls in the US during and after the World Wars as well as during the Nixon administration, they would know that such efforts to control prices, limit business pricing power or control bank lending have all failed in the past. Historically, once the government was forced to give up price controls or loosen regulation, inflation spiked and caught up with reality very quickly. I recommend people who flirt with MMT to read Allan Meltzer’s “History of the Federal Reserve”. It will disabuse these economists of the idea that prices and corporate profit seeking can be restrained by regulation with limited costs to society (Real Bills Doctrine, anyone? Anyone?).

If they had a knowledge of the history of price controls and business regulation in the US, they certainly wouldn’t write such humbug as: “The more actively we regulate big business for public purpose, the tighter the full employment we can achieve and the more resources we can devote to the Green New Deal while preserving price stability”. Please hold my beer while I bang my head against a wall for an hour…

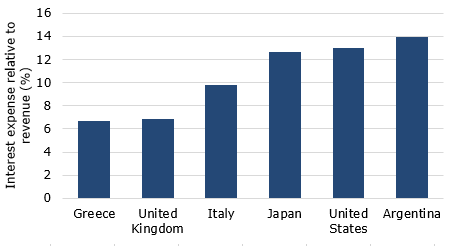

Furthermore, proponents of MMT seem to believe that inflation can only get out of control if deficits are too excessive for too long (whatever that means) and government bond interest rates rise too fast in reaction to rising inflation. If they had read Peter Bernholz’ “Monetary Regimes and Inflation” they would know that hyperinflation is more often than not triggered once the major part of government revenues have to be used to pay for interest expenses on issued bonds. In that case, the government is effectively forced to issue new bonds to finance interest payments for existing debt, which creates an exponential growth in government debt. This is also the time when investors start to pull back and demand significant risk premia on newly issued bonds which in turn translates into higher interest expense for the government. As Peter Bernholz explains, this spiral typically starts, once interest expenses reach c. 30% or more of government revenues, though in the case of the US – thanks to its status as world reserve currency – that tipping point may be significantly higher. And as our chart shows, the interest expense of the US as well as most countries in the world is currently much lower than 30%, so there is significant room to run massive deficits for years if not decades. But that does not change the math that eventually, debt costs will get out of control.

Defenders of MMT may argue that almost all of my counterexamples of failed inflation control were monetary policy measures, not fiscal policy measures that they advocate. But given that monetary policy is much more flexible than fiscal policy and much less influenced by political interests than fiscal policies, I have yet to be convinced that fiscal policy will be able to achieve what monetary policy has failed to do over decades. I am seriously trying to find out if MMT is a promising way forward but I am not convinced it is, yet.

Interest expense as share of revenue

Source: World Bank, Fidante Capital.