I am sorry to darken the mood of all the active fund managers who read this, but current high inflation will be felt by them in coming months.

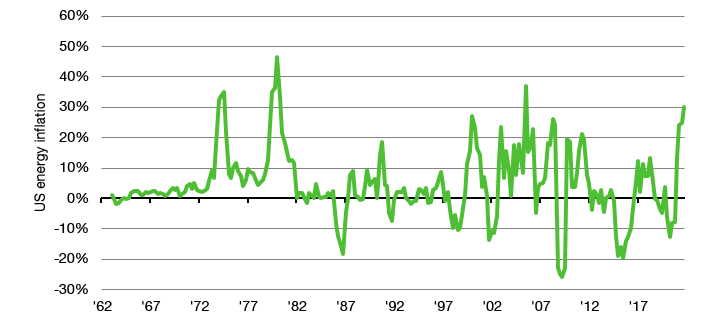

Inflation has been running hot in the last six months in the United States and other countries. Here in the UK, we are debating the impact of the “cost of living crisis” on consumption and similarly, one would expect that high inflation could lead to lower consumption in the United States as well, though the recent retail sales data clearly shows a strong consumer at the moment. A key driver for lower consumption going forward may be high prices for fuel that are felt across the entire economy. And at the end of 2021, energy inflation in the United States reached 30% compared to the previous year.

Energy inflation in the United States

Source: Bloomberg

But if households have to spend more money on the items of daily life they have to find that money somewhere and that usually means cutting back on other cost factors – particularly those that are easy to cut.

With the advent of index funds, one area where it is easy to cut costs is fees for investment products. You can simply take your money out of higher-fee actively managed funds and shift it into lower-fee passive funds. And according to a new study by Swasti Gupta-Mukherjee and Hae Mi Choi from Loyola University that is what seems to happen. They found that if quarterly inflation rates for US energy goods and services spike above 4%, then every additional percentage of quarterly energy inflation increases outflows out of actively managed mutual funds by 0.33% on an annualised basis. Note that in the fourth quarter of 2021 the quarterly energy inflation rate rose to 8.3%, so outflows out of actively managed funds may have accelerated by 1.5% annualised. In times of low energy inflation, the effect is much smaller, in fact about two thirds smaller. If inflation is below 4% every percentage point increase in energy inflation increases outflows by 0.1%.

But this money isn’t just leaving actively managed funds and the stock market altogether. The research indicates that investors are not abandoning stocks in times of high energy inflation but are moving into low cost passive investments to save fees. While actively managed funds experience substantial outflows in times of high energy inflation, passive funds see accelerated inflows and the gap in flows between active and passive funds becomes larger during these day.

As energy inflation remains high during this winter this is bad news for active fund managers, but there is light at the end of the tunnel. Energy inflation is likely to decline throughout the rest of 2022 which should ease the pressure on investors’ wallets.

Hard to argue excl the last 12 months. I think the worm has turned. More index in global bonds (more US, Japan, Italy and Spain), more global equities (very expensive US - even after recent falls) - no thank to both. Index EM anything??? There is certainly a place for indexing, however now more than ever....now is NOT the time. In my humble opinion at least :-(

The main driver, of course, remains the fact that active managers have continued over very long periods of time to underperform their index benchmarks. In addition, just picking funds with great five and ten-year track records has not worked as past performance has truly not been a good predictor of future relative performance. In fact, statistically speaking, the best predictor of future good relative performance in aggregate has been low fees. That said, every time the market gets jumpy, you can count on hearing the words, "I think it is now a 'stock-pickers' market. You can no longer just jump on index funds with your money." Right. S/

Although it is tempting so choose active management in small caps and emerging markets - high transaction costs - and fees - seem to eat up any perceived inefficiencies. I always remember Jack Bogle's words that indexing is like playing the game at par every time.