Motivated reasoning in action

As I look at the carnage of the Covid-19 panic in financial markets, I cannot help but think of the psychological processes that got us here. In my view, one of the key driving forces behind the interpretation of the Covid-19 outbreak is motivated reasoning.

For those who don’t know about motivated reasoning, it is our tendency to use facts in the way that best fits our motivations and serves to further our goals. In short, we think we argue like scientists but what we do instead is argue like attorneys.

Politicians and pundits do that all the time and you can see it in action with President Donald Trump and his White House aides. At his press conference on the Coronavirus outbreak on Wednesday, he held up a page from the Global Health Security Index that showed the United States and the UK are the two countries most prepared to withstand a pandemic. However, the report also states in bold letter that:

“National health security is fundamentally weak around the world. No country is fully prepared for epidemics or pandemics, and every country has important gaps to address.”

There is a reason why the colour coding for the index ranges from yellow to orange and red. No country scored enough points to warrant a green coding.

While the White House has an incentive to spin the facts in its favour to avoid a drop in Trump’s approval ratings that could damage his re-election chances, financial markets have gone into full panic mode based on a different kind of motivated reasoning. The bull market of the last decade has long been derided as the most hated bull market in the world. Even though the US economy was strong and company profitability was good, people were constantly arguing about high valuations and how all of this has to end in tears.

Now, we have got an external factor that can shock the Chinese and global economy in ways that are hard to assess. So all kinds of pundits can bend the facts to fit their worldview. Is it any surprise that Nouriel Roubini is suddenly coming out of the woodwork, warning that the worst is yet to come for markets? I think Josh Brown of Ritzholtz Wealth was spot on in his initial assessment on Twitter:

Markets needed a reason to sell and Covid-19 provided one. The fact is that nobody really knows what the effect of Covid-19 will be on the Chinese and the global economy. Currently, most economists agree that the impact on Chinese GDP growth will likely be in the range of 0.5% to 1.0%. Yesterday, the OECD published its assessment predicting a c. 1.0% decline in Chinese growth. I have yet to see a serious economist who predicts a decline in Chinese growth of 2% or more this year.

And while economists are no epidemiologists, we are able to assess the likely impact a Chinese growth shock will spread throughout the world. Shagil Ahmed and his colleagues from the Federal Reserve have recently estimated the spread of a severe economic shock in China throughout the world. In their paper, you can find the impact of a one percentage point decline in Chinese GDP on economic growth around the world. The chart below is taken from their paper and shows the impact of such a growth slowdown in China on the global economy.

Global spillover of a 1% growth slowdown in China

Source: Ahmed et al. (2019). Note: AFE = Advanced Foreign Economies (i.e. developed countries outside the USA), EME = Emerging economies.

A one percentage point decline in Chinese growth should reduce US growth by about 0.2 percentage points and developed market growth by about 0.5 percentage points. This is clearly not enough to put the US economy anywhere near recession. However, vulnerable countries like Germany and Italy will likely be hit hard enough to trigger a recession. My opinion remains that Germany and Italy are already in recession and France may slide into one if Chinese growth slows down as expected.

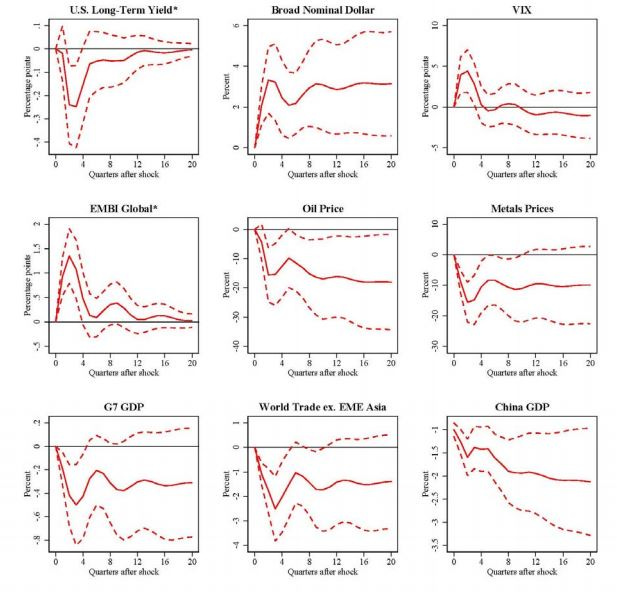

Such a growth slowdown would not be nice, but it isn’t the end of the world either. What we should expect as a reaction of financial markets is shown in the next chart. In short, commodities would be hit the hardest with oil prices declining by about 20% and not recovering for a long time while metals prices decline by about 15% and then recover a bit. One would also expect a one to two percentage point drop in world trade a stoner US Dollar and a brief decline of US Treasury yields. All of these things and more have happened since the beginning of the year. If I compare the market action of the last week, I would say that last week’s panic has significantly overshot the likely impact of the Covid-19 pandemic on the global economy and financial markets.

Financial market impact of a 1% growth slowdown in China

Source: Ahmed et al. (2019). Note: AFE = Advanced Foreign Economies (i.e. developed countries outside the USA), EME = Emerging economies.

Now, I can hear the pessimists say that the last week, we have seen evidence that Covid-19 spread to Europe, the United States and other countries and now threatens to become a global pandemic. Hence, the economic impact may be much worse than these simulation show.

To this, I reply that SARS spread around the world in 2003 without much of an economic impact either. The main reason why the Chinese economy is likely to slow down significantly is not because of the death toll of the virus. It is because China essentially shut down its economy for several weeks to contain the virus. In the developed world, you simply cannot shut down an entire region and lock people into their houses to stop the pandemic. This is why it is likely that the virus will continue to spread around the world, but at the same time, life will go on. People may shop less in stores but more online. Factories will continue to operate and offices will be filled with people working on whatever they are working on every day. Even if the Covid-19 epidemic can never be contained and will linger on forever, the likely impact on the economy is going to be small. The chart below is taken from a study about the economic impact of SARS, assuming on the one hand that the epidemic was short-lived and on the other hand, that it persisted for 10 years with recurring outbreaks. As you can see, while the Chinese economy might suffer more than the currently anticipated one percentage point, the Western world will likely be fine.

Estimated economic impact of SARS pandemic

Source: Lee and McKibbin (2004).

To summarise, my assessment is that the Covid-19 pandemic is bad and will likely get worse before it gets better. But the economic impact is likely going to be limited. That means that the current market panic is probably overdone. It may sound weird, but if you are trying to overcome motivated reasoning (which I hope I have done here, though I cannot be sure), you will have to learn to be pessimistic and optimistic about the same thing at the same time. Maybe that is why it is so hard for us to deal with facts as scientists do. It often requires us to hold two contradictory views at the same time.