Longstanding readers know that I am a bit of a fan of research on narcissists. No, there is absolutely no personal reason why I am so interested in that topic, believe me. But by now, I have written quite a few articles on the (mostly negative) impact of narcissists on organisations. Yet, in some circumstances, narcissists can be good for a company, at least in the short run, as I have explained here. Another upside of having a narcissistic executive is that they are better at manipulating analysts into better ratings and more optimistic forecasts.

A group of researchers examined how narcissistic CFOs manipulate equity analysts covering their stocks. To do this, they did two things. First, they invited 203 experienced business practitioners with an average of 17.4 years of professional experience in finance, sales, or business to participate in a lab experiment. In that lab experiment, they could measure the narcissism of each participant with a standardised questionnaire and then confront them with an analyst. One half of the participants were confronted with a hard-headed analyst who makes up his mind and is hard to influence. The other half of the participants were confronted with an analyst who was described as a bit of a pushover who could be persuaded to move his forecasts and ratings around a bit. Of course, both analysts were played by research assistants and followed a pre-defined script.

The participants who were asked to play a CFO meeting an analyst were asked how likely they think they were going to employ one of six persuasion tactics, ranging from something as harmless as getting the analyst to like the CFO to something close to blackmail like threatening to cut off access to the CFO if the analyst does not provide a more favourable rating.

Persuasion tactics by CFOs meeting analysts

Source: Ham et al. (2023)

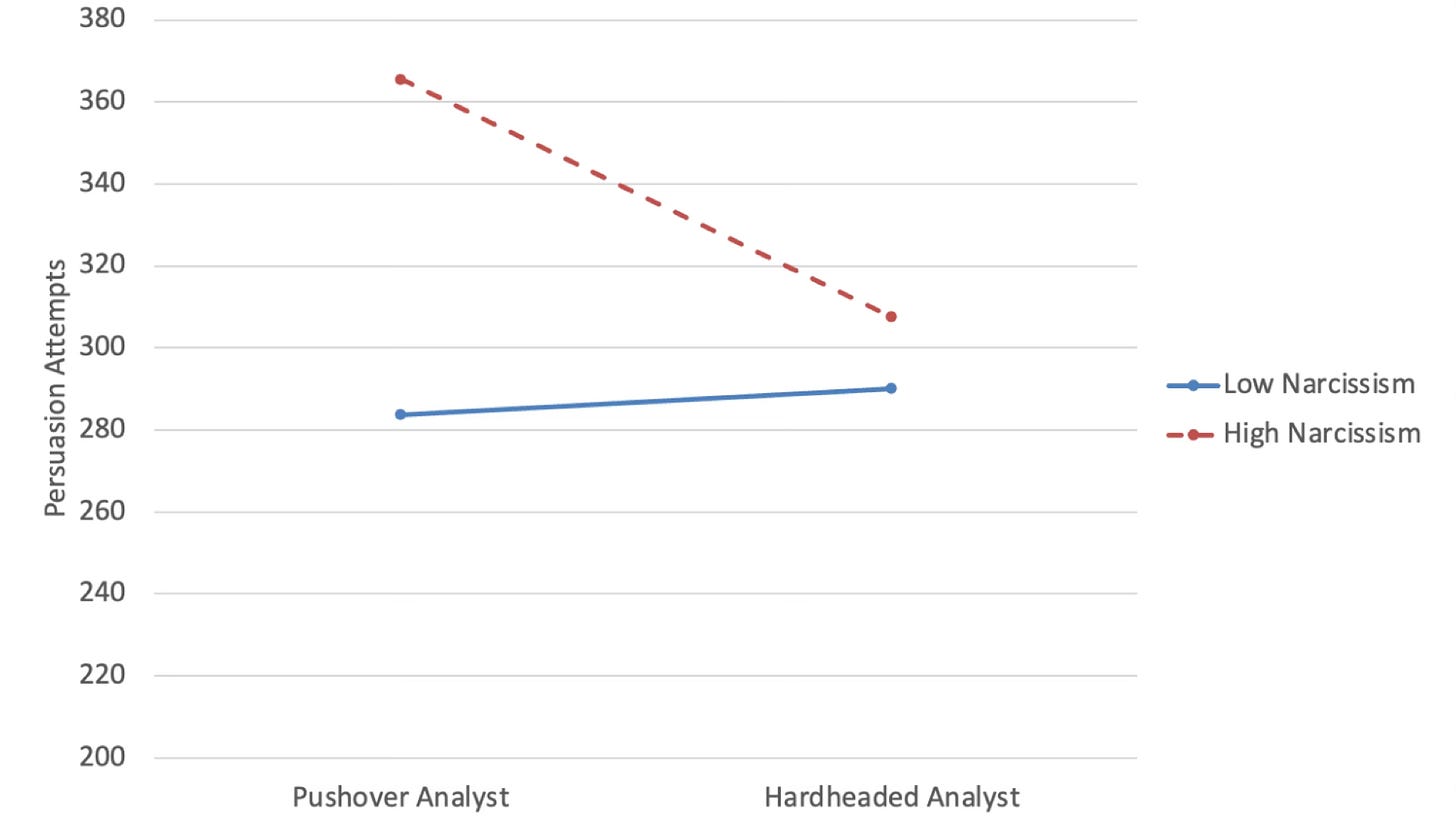

The chart below shows that participants who score highly in the narcissistic assessment are generally more likely to try to persuade analysts, but they focus their attention on the pushover analysts that they perceive to be easily manipulated.

Persuasion attempts by CFOs meeting analysts

Source: Ham et al. (2023)

Ok, that’s the laboratory. Narcissists look for victims and when they find one, they try to manipulate them to their advantage. But what happens in real life?

To check real-life outcomes, the researchers used the size of the signature of CFOs as a measure of narcissism – something that is increasingly common.

Then they looked at earnings call transcripts and found that more narcissistic CFOs talked more, were more optimistic about their company’s prospects, used more corporate euphemisms, and generally showed more engagement with analysts. The result was that on average, analysts issued more optimistic earnings forecasts and better ratings for companies with more narcissistic CFOs, which is great news for the company and its CFO, but detrimental to investors because analyst forecasts and ratings become less reliable.

Interesting. By coincidence I listened to the attached podcast this week, which although mostly about relationships does briefly reference leaders and CEO's. https://podcasts.apple.com/us/podcast/428-how-to-spot-a-narcissist-the-impact/id1333552422?i=1000646001645

Let me get this straight. We accept that CEOs are often narcissists. If we didn't, then no more Elon, Larry Ellison, Steve Jobs. But narcissistic CFOs are red flags? Sounds actionable to me. A.I. should be able to determine which CFOs are highest on the N-scale.