Narratives, the stories we tell around our investments or specific economic or life events, are increasingly recognised as an important driver of investment decisions. Robert Shiller elevated the topic into the economics mainstream with his Presidential address to the American Economic Association in 2017 and has since turned it into a book. Ben Hunt of Epsilon Theory, meanwhile, has built an entire business around the concept of narrative economics.

But so far nobody has really checked if and by how much narratives can influence the price of assets, for example. This is where Dor Morag and George Loewenstein come in. They recruited in total about 1,500 participants via Amazon MTurk and put them into the situation of an asset owner, who thinks about selling the asset. The assets in question in this case were taken from the original behavioural finance experiments that established the endowment effect: A mug or a hat.

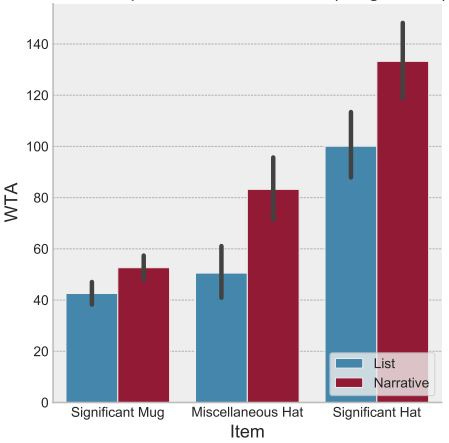

In the case of the mug, the participants were asked to either list the features and the condition of the mug (list condition) or to write down a story (narrative) how they came to own the mug and why that mug is significant to them personally. Then they were asked at what price they were willing to sell the mug or if they were unwilling to sell the mug at any price. Note that the mug didn’t have any significance for the participants. They just had to invent a story why it is significant to them. Yet, when asked about the price they were willing to accept for the mug, 23% of the participants who had to write a story about the mug were unwilling to sell it at any price, compared to 17% of the participants who just had to make a list of its features. And of those who were willing to sell, the people who had to invent a story about the mug asked for a higher price than those who just had to make a list.

To confirm the results, the experimenters conducted a second experiment with different participants and gave them a hat. But this time, some participants were told that they had received any old hat while others were told that they were given a hat that had personal significance for them. Then, in each of these two scenarios, some people were asked to write a list of attributes of the hat, while others were asked to write a story about the hat.

Again, in the narrative situation, people were less willing to sell the hat and if they were willing to sell it, they did so only at a higher price. And if they were told that the hat had a personal significance to them, their willingness to sell declined even more and the price they were willing to accept rose even more.

On average over all experiments, writing a story around the item they owned made them about two thirds more likely to hold on to the asset at any price and increased the price they were willing to accept for the mug by between 25% and 80% depending on the circumstances.

Price people are willing to accept (WTA) for a mug or a hat

Source: Morag and Loewenstein (2021)

Now think of the high-flying stocks of the day. Almost all of them have a great story AND personal significance to many of its investors. Apple has a great story around a founder that revolutionised mobile phones and many investors probably have a personal connection to apple products because they own an iPhone or a Mac. Tesla has a charismatic founder who promises to revolutionise the world and some investors probably have made positive experiences with the cars. Or take Amazon, which many of us use regularly and might have some personal significance to many of us. Or Google, or Facebook, or Netflix, etc. but also think of Elizabeth Holmes who created a fabulous story around a product of high personal significance to many people and that way turned the fraudulent Theranos into a multi-billion dollar company.

In fact, there is a great narrative to be had around all the FANG stocks and many of these companies have created products that are personally significant to a lot of investors. Given the experiment by Morag and Loewenstein it shouldn’t surprise that these stocks trade at higher valuations than most other stocks. Stories matter, and if a good story increases the value of a simple mug or a hat by 25% to 80%, then you can imagine what it does to stocks, houses, art, etc.

so...stories create value

I realize you probably don’t respond to comments Joachim, but what I’m wondering is how narrative economics factors into your decision making process.