Navigating the ESG Rating chaos

One of the major issues of ESG investing remains that there is no universal standard of how to rate a company and how to aggregate different risk factors. While the average correlation between credit ratings of Standard & Poor’s and Moody’s is about 0.9, the average correlation between the six biggest ESG rating agencies is about 0.46 as Rajna Gibson and his colleagues recently reported. If one looks at the three pillars of ESG ratings individually, the picture gets even worse. In the environmental dimension, the average correlation between ratings providers was 0.43, in the social dimension it was 0.32 and in the governance dimension – arguably the one that is the most established in practice – it is a mere 0.20.

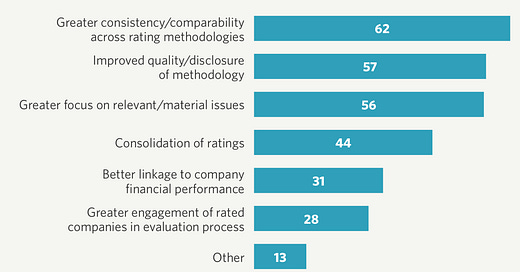

Given these vast differences between ratings providers it is no surprise that the main complaint of investors about ESG investing is its lack of standardisation. SustainAbility asks several hundred investors each year about their opinions on ESG ratings agencies and the quality of their work. They also ask about the biggest challenges investors face in ESG investing. And in 2019 the number one issue was, as every year, the lack of standardisation.

Wish list of ESG investors for ratings agencies

Source: SustainAbility.

Yet, the commercial interests of ratings agencies obviously go against this desire of greater standardisation, because if one can easily compare the quality of two products, one can also easily compare the price of these products. And more standardised products typically command a lower price premium and hence a lower profit margin for the service providers. Thus, ESG ratings providers have little incentive to create a unified standard of ESG ratings.

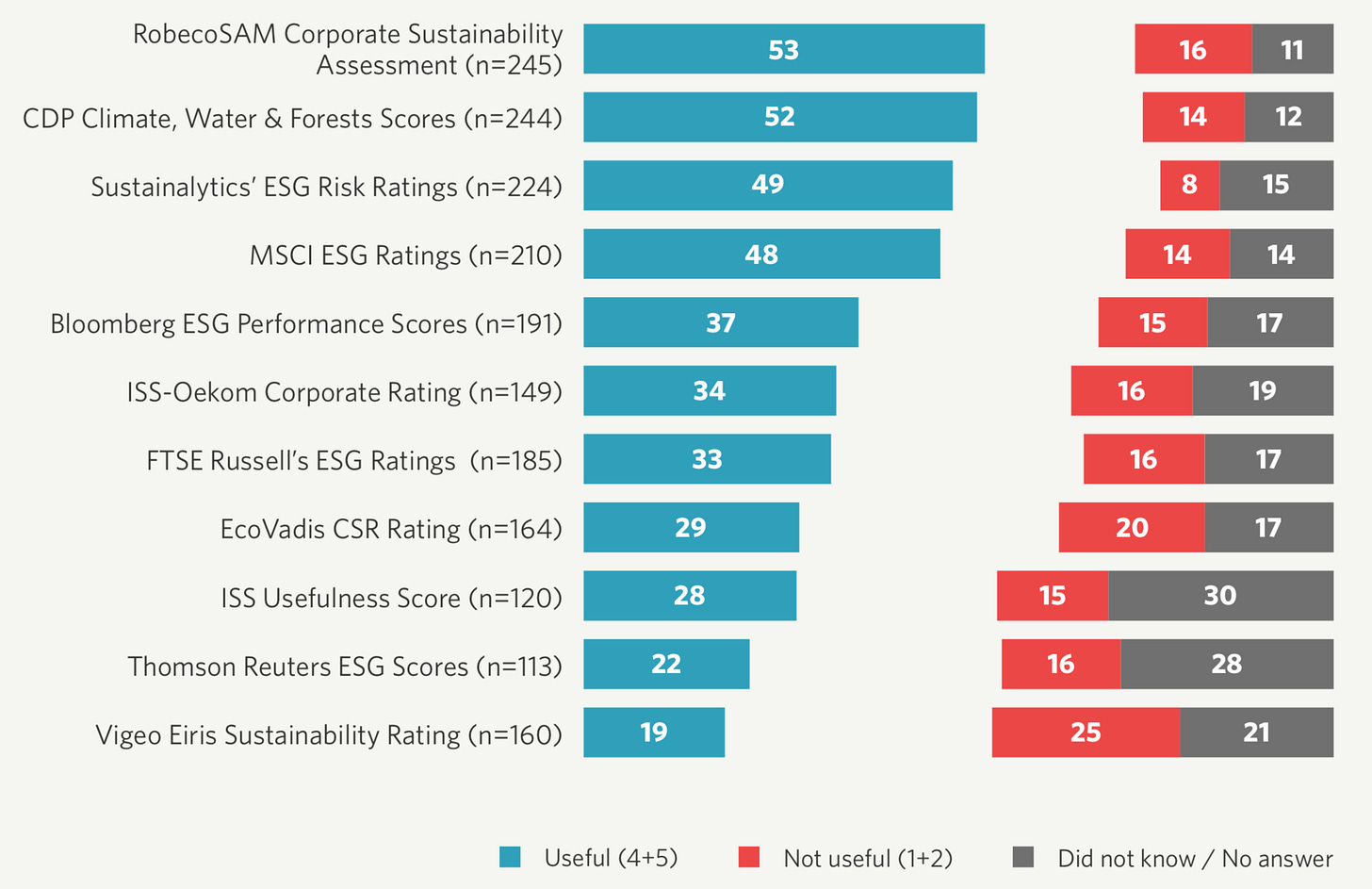

For investors, this means that until one or two ESG ratings providers become clear market leaders, they have to figure out for themselves which ratings system to use and which one to skip. Luckily, the Sustainability report can help here. They asked a set of major investors to rate the ESG ratings agencies based on the usefulness of their ratings. And for several years now, both RobecoSAM and the Carbon Disclosure Project (CDP) have topped the list ahead of the two most commonly used ratings providers MSCI ESG and Sustainalytics. My personal experience with these ratings agencies is that RobecoSAM indeed is a bit better than MSCI ESG and Sustainalytics, but unfortunately, no single ratings agency will have all the information in the form you need it as an investor. I tended to use a combination of RobecoSAM and MSCI ESG which was a hazzle sometimes because of the different methodologies but at least got me where I wanted to be in terms of analysing nonfinancial investment risks.

Usefulness of ESG ratings provider

Source: SustainAbility.