No flow, no problem

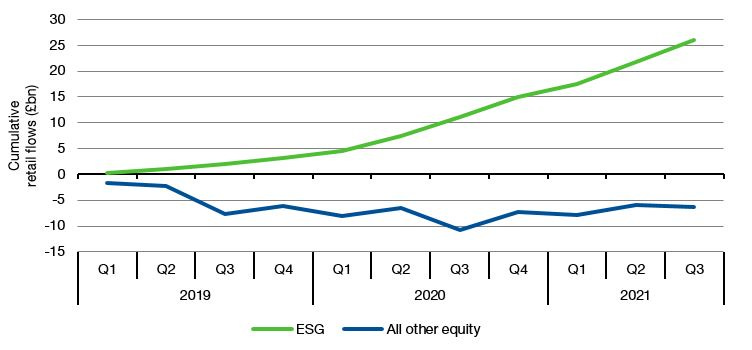

In Europe and the UK, ESG investing ids the fastest-growing investment trend ever. Assets under management of dedicated ESG funds grew by c.75% per year between 2019 and Q3 2021 and the fund flows into equity ESG funds are larger than all other equity fund flows put together. Not even index funds when they were such a small part of the market as ESG funds are today, experienced growth rates similar to that.

Retail fund flows into equity funds in the UK

Source: The Investment Association

Given these large flows into ESG funds what should you do if you happen to a be a fund manager with a fund that isn’t able to attract new money for some time? Easy, you can just turn it into an ESG fund, hoping that the ESG label will attract some much needed money. Some time ago, I wrote about how US funds that had poor inflows converted into ESG funds and subsequently attracted new money from investors. Back then, I emphasised that this was not a form of greenwashing since only the funds that changed their portfolios to better align with ESG benchmarks attracted flows while funds that did not, missed out on the additional investments.

A new study by Markku Kaustia and Wenjia Yu confirmed these observations but also delivered an important additional insight: The funds that were converted from conventional to ESG weren’t underperforming funds. In fact, the funds that were converted to ESG funds tended to be funds that outperformed their peers but at the same time weren’t able to attract similar inflows as their poorer-performing peers. For whatever reason, these funds could not convert superior performance into additional investment flows and the relabelling as ESG fund gave them another lease on life.

After the funds were converted into ESG funds, they tended to again align more with ESG benchmarks and reduce their investments in industries like oil & gas, tobacco or gambling. But unfortunately, it didn’t seem to do much for the repurposed funds. On the bright side, after being rebranded as ESG fund, the performance of these funds didn’t change much, so investors didn’t suddenly experience lower returns as so many ESG-critics fear. But unfortunately, the flows into these rebranded funds also didn’t materially increase. The difference between this new study and the previous one I link to above is however, that in this new study, the researchers only looked at fund flows in the six months after rebranding, so it could simple be that it takes time for these additional flows to materialise after rebranding.