Not all yield curve inversions are created equal

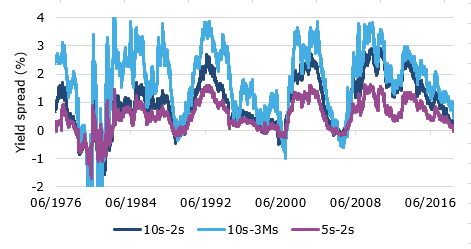

Much has been said in the last week about the inversion of the US Treasury yield curve between 5-year and 2-year yields. While most analysts have warned that yield curve inversions are an unreliable indicator of recessions, not all inversions are created equal. Going back to 1976 we have analysed the predictive power of three different measures of yield curve steepness in the US. First, we examined our preferred measure of 10-year yield minus 2-year yield (10s-2s). Then we examined the difference between 10-year yields and 3-month yields (10s-3Ms) and finally 5-year minus 2-year yields (5s-2s).

Using daily data, we consider a valid inversion whenever the difference between long-term and short-term rates turns negative. However, if the steepness of the yield curve temporarily becomes positive again and then inverts within one month, we consider both inversions as part of the same event. Since 1976 the US has had 5 recessions, but the yield curve inverted much more often. 10s-2s inverted 11 times, 10s-3Ms inverted 13 times and 5s-2s inverted 19 times. This already shows how unreliable yield curve inversions as recession indicators are. Per recession, the median number of false alarms is one for the 10s-2s and two for the 10s-3Ms. This already indicates that the 10s-2s are less error prone than the other two measures.

However, the lead time between a yield curve inversion and the onset of a recession can vary dramatically. For the 10s-2s signal the inversion happened between 116 trading days before the 1990 recession and up to 384 trading days before the 2001 recession. The 10s-3Ms can be more timely since it inverted just 63 days before the 1981 double-dip recession and 305 trading days before the 1980 recession. The 5s-2s are all over the place. It was a timely signal 63 days before the onset of the 1981 recession (but even then, had two false alarms beforehand) and it was extremely unreliable before the 2007 recession with a lead time of 560 trading days.

Overall, our assessment is that the 5s-2s is extremely unreliable as an early warning indicator for recessions since it has twice as many false alarms as correct signals and the lead period before a recession varies extremely widely. 10s-2s and 10s-3Ms are clearly more reliable indicators with not much of a difference between them. Historically, the 10s-3Ms inversions were a bit more accurate in timing the recession but the 10s-2s had fewer false positives.

Steepness of the US Treasury yield curve

Source: Bloomberg, Fidante Capital.