The Fed has recently changed its monetary policy goal from an inflation target of 2% to an inflation target of 2% “over time”, which means the Fed will allow inflation to rise above 2% for a while before it hikes interest rates. At the moment, the Fed and markets expect the Fed Funds Rate to remain at the current level of 0.25% until 2023, but in my view, the Fed Funds rate will stay at current levels for much longer and at least the next five years.

Why? Because if we go back to the aftermath of the financial crisis, it took until the end of 2011 for PCE inflation to rise to 2%. The average inflation since 2010 is still under 2%. And now, we are trying to dig our way out of the deepest recession in 90 years. Compared to what we are facing today, the financial crisis was a “mild recession”.

I think average inflation targeting (AIT) as the Fed is aiming to do now is hardly going to make a difference and is almost certainly unable to lead to significantly higher inflation or let inflation climb much about 2%.

And even some people in the Fed think so. During the strategy review of the Fed, several economists were tasked with a series of analyses of how new monetary policy tools would fare compared to the existing inflation targeting approach. These papers have now been made public and one of them addressed the issue of alternatives to inflation targeting. Jonas Arias and his colleagues looked at average inflation targeting over a 4-year and an 8-year window as an alternative to the traditional inflation-targeting approach of the Fed. They also looked at price-level targeting. The chart below shows their model simulations of the Fed Funds Rate in reaction to a hypothetical mild recession starting in Q1 2020 (the study was done in 2019 before we even knew what Covid-19 is).

Modeled Fed Funds Rate in a mild recession under different monetary policy strategies

Source: Federal Reserve. Note: Black line indicates classic inflation targeting, AIT = Average Inflation Targeting, PLT = Price-level Targeting.

As you can see, even in a mild recession, the average inflation-targeting approach that the Fed has now adopted leads to interest rates staying at 0.25% until mid-2024, and the Fed Funds rate reaches 2% only around 2028. Compared to the traditional inflation targeting approach, average inflation targeting rules imply that the Fed Funds rate stays lower for much longer. Any given level for the Fed Funds Rate is reached c. 2 years later with 8-year average inflation targeting than for traditional inflation targeting. So we should all kiss higher short-term interest rates goodbye. Savings accounts and CDs will earn you nothing. The United States has caught up with Japan and Europe and will remain at current interest levels for five to ten years at least.

Oh, and did I mention that the above simulation is for a mild recession? What do you think is going to happen in the aftermath of a massive recession like the one we experienced this year?

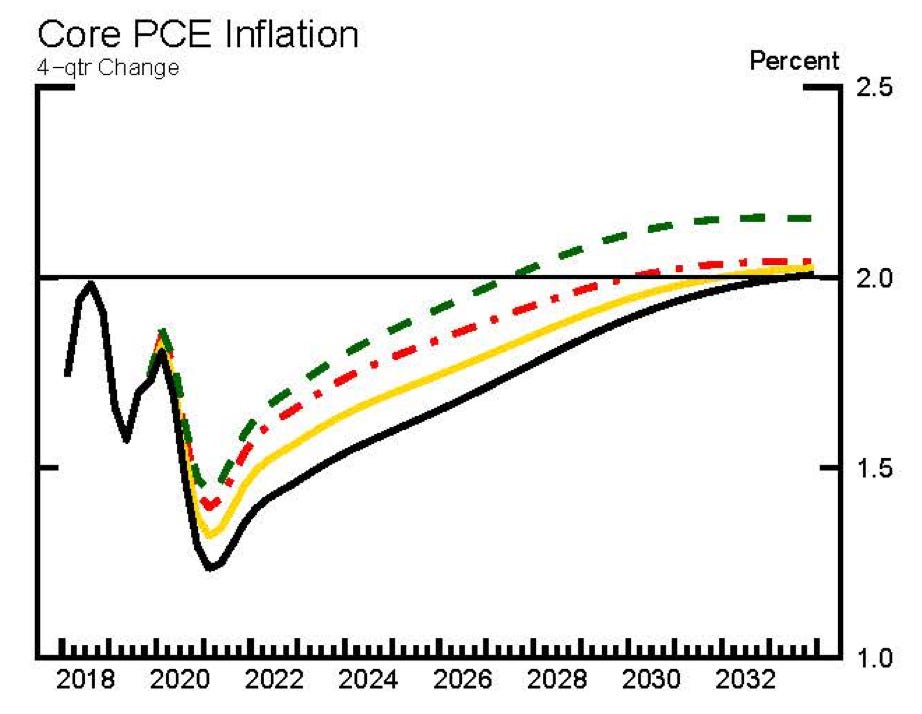

But if the Fed leases interest rates so low for so long, isn’t that going to spur inflation? Not according to the Fed. In fact, the shift to average inflation targeting is hardly making a dent in the projected path for inflation. Under average inflation targeting, core PCE inflation is projected to reach 2% in 2030. Ten years from today. And that after a mild recession.

Modeled Fed Funds Rate in a mild recession under different monetary policy strategies

Source: Federal Reserve.

You can criticise these models as being wrong and underestimating inflation, but the Fed doesn’t have a history of underestimating inflation. In fact, the models used to come up with the results shown above are the same models that have over the last two decades been criticised as predicting a rise in inflation that then never materialised. That doesn’t mean that they now can be too dovish since there are potential wildcards that could trigger inflation as I have discussed here. But personally, I wouldn’t bet my money on overshooting inflation or a hawkish Fed in the five years or more.

Hello Joachim, Event with Biden winning the US election, inflation will take that long?