Nothing new but still impressive

In my book, I use a chart from some older research of Amit Goyal and his colleagues that showed that pension funds choose to switch asset managers at exactly the wrong time. They pick asset managers with a great track record over the last one to three years and fire the ones with a poor track record. Yet, in the three years after switching the asset managers the hired managers underperform while the fired managers outperform.

In essence, pension fund managers and their consultants are unable to select outperforming asset managers and destroy value for their plan beneficiaries by changing asset managers.

Now, Amit Goyal and his colleagues have extended their research to cover pension funds globally with a total of $1.6tn of assets. They examined the decisions to hire and fire external asset managers across a wide range of asset classes and regions. And while the results aren’t really new, it is still impressive how poor plan sponsors and their consultants are in selecting asset managers.

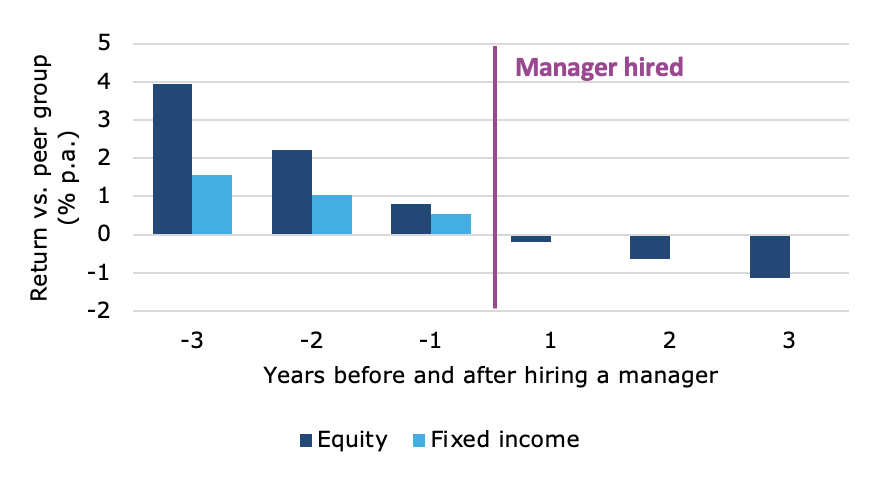

We can look at equities and bonds and find in both asset classes that hired managers had a great track record over the three years before they were hired and underperformed their peer group in the three years after being hired…

Performance of hired asset managers by asset class

Source: Goyal et al. (2020).

…or we can distinguish between US pension plans and international pension plans…

Performance of hired asset managers by region of pension plan

Source: Goyal et al. (2020).

…or we can distinguish between larger, presumably more sophisticated plans and smaller plans…

Performance of hired asset managers by size of pension plan

Source: Goyal et al. (2020).

It is simply impressive how pervasive the lack of skill in picking asset managers is. In fact, Goyal and his colleagues can identify only two significant drivers of the hiring decision.

One is the performance of the asset manager over the previous one to three years and the other… if the plan sponsor or the consultant has a personal relationship with the asset manager. Plan sponsors and consultants hire their friends or people with a good past track record. Everything else doesn’t matter – no matter how much they pretend it does.