It has been a difficult time for many companies in the last two years. First, raw material costs rose rapidly, then wage inflation increased the money spent on wages and while all of this was happening, interest rates rose rapidly driving the cost of debt and the cost of equity to much higher levels. This massive cost increase has been particularly hard to digest for companies with high operating leverage. But thankfully, we are embarking on what seems like an extended period of lower interest rates, which may benefit these companies more than others.

Operating leverage is one of these concepts that is used in very different ways by different investors. Theoretically, the operating margin measures the rate at which the operating earnings of a company change if revenues change. My preferred way to measure operating leverage is one that has also been used in a new study by Luis García-Feijóo and his collaborators. You add up the cost of goods sold and the selling, general, and admin expenses (SG&A) and divide it by total assets. In essence, you measure the costs incurred to sell stuff relative to the total capital used to run the business. I know, there are other definitions, so accounting gurus can stop writing me hate mail (you wouldn’t believe these accounting types, they can get feisty…).

The benefit of high operating leverage is that a small increase in revenues will lead to a large increase in profits and thus, companies with high operating leverage tend to have high earnings multiples in times when the cost of capital is low or when revenues grow strongly. On the other hand, when the economy slows down and revenues decline, it often takes very little for these companies to become loss-making.

Because higher operating leverage means systematically higher operational risks for a company, one would expect that in the long run, companies with higher operating leverage outperform companies with low operating leverage. This is indeed what has been observed in markets (see for example here).

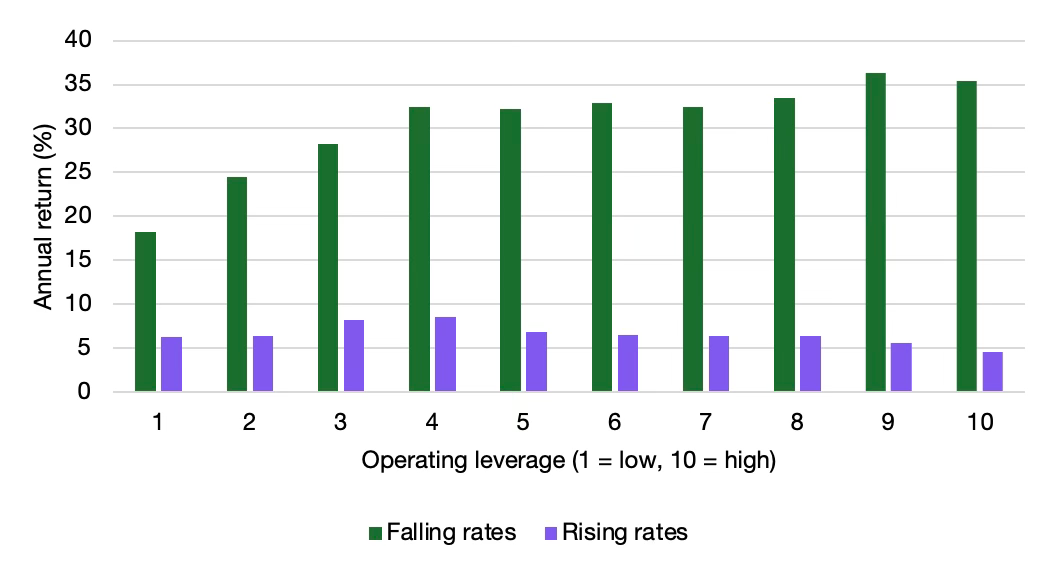

But as Luis and his colleagues show in their new paper, this outperformance of companies with high operating leverage doesn’t exist all the time. The chart below shows the average annual return of US companies sorted by operating leverage and the financial conditions at the time. In times of declining rates and looser monetary policy, companies with high operating leverage significantly outperform companies with low operating leverage. But when financial conditions become more constrained as they have in the last two years, they start to slightly underperform.

Luckily, this period of constrained financial conditions is coming to an end soon, so investors should start looking for companies with high operating leverage and start investing in them.

Return of companies with varying degrees of operating leverage

Source: García-Feijóo et al. (2023)

Clear, short, to the point. Nice post.

...those accountant types get us all in the end.......