One of the more common questions I get from readers is if people who are fans of ESG investments are willing to give up performance. I have argued here why I think this argument is flawed and shown here that in practice, there is no trade-off between sustainability and returns. Apart from that, you can read here that investors are willing to give up quite substantial returns for the privilege of investing aligned with their values.

But there is also the human tendency of motivated reasoning. If you invest in sustainable investments, you start to believe that these investments have higher performance. Or is it the other way round? That is what I was asking myself when I read the results of a new survey of investors.

The survey asked some 18,000 US retail investors what they thought about ESG investments and why they invested in them. One of the key outcomes was that investors on average think that ESG investments will have substantially lower returns over the next 10 years than the market. And notably, with the advent of the Ukraine war and the subsequent rally in energy prices and energy stocks, the gap between expected returns for the market and ESG investments widened a lot.

Expected returns for equity markets and ESG investments

Source: Giglio et al. (2023)

But just because the average investor thinks that ESG investments have lower returns doesn’t mean they will not invest in it. The chart below shows the expected return difference between ESG investments and market returns and the share of ESG investments in the portfolio of these investors. To nobody’s surprise, investors who think that ESG investments will substantially outperform the market had higher allocations to ESG. But note that the second-highest allocation to ESG investments was found in people who thought these investments would underperform the market by 1-2% per year. This gives you an indication of how much performance some investors are willing to sacrifice.

Allocation to ESG investments based on return expectations

Source: Giglio et al. (2023)

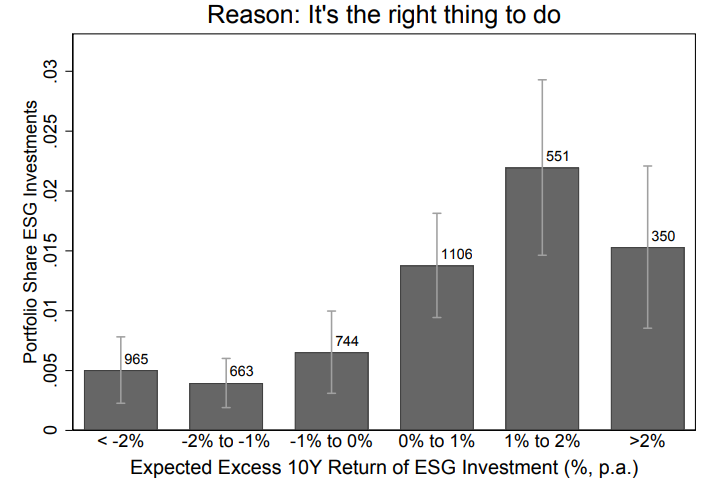

But look at today’s final chart below showing the beliefs of people who invest in ESG assets not for return reasons but because it is the right thing to do. Higher allocations to ESG investments go along with higher return expectations. If it is the ‘right thing to do’ why should ESG investments outperform the market? In my view the chart is plotted the wrong way around. Instead of showing the allocation as a function of the expected return of ESG investments they should have plotted the expected return of ESG investments as a function of portfolio allocation. Because I suspect, many investors first decide to invest in ESG because ‘it is the right thing to do’ and then, when asked about their return expectation for these investments provide an overly optimistic answer.

Allocation to ESG investments based on whether it is the right thing to do

Source: Giglio et al. (2023)