Piketty thinks redistribution hasn’t worked

Ok, the headline may be exaggerating what he really thinks, but one thing that annoys me about Thomas Piketty is that he tends to have one good idea (often one that is debatable, but that’s fine) and then he turns it into a 1,000-page book with lots of sweeping arguments for social change.

In late 2020, he published another paper that he and his colleagues admit is a work in progress, but I can see the seeds of his next tome in it. So, let me save you from having to read another book of his in a couple of years’ time, and let’s get straight to his argument.

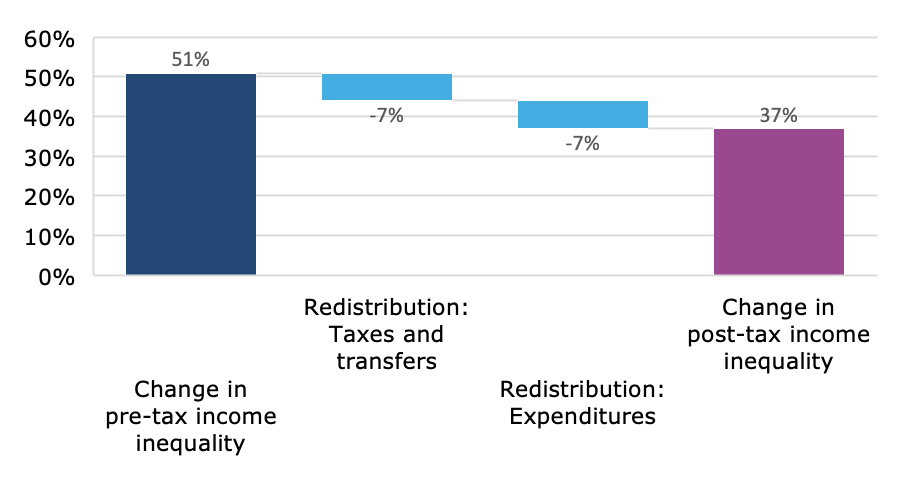

He and his colleagues collected data on income inequality in France since 1913 and compared it to existing data in the United States. This time they focused on pre-tax income inequality and post-tax inequality to assess if redistribution has worked or not. And he comes to the important conclusion that the increase in income inequality in both France and the United States over the last four decades has been predominantly driven by an increase in pre-tax income inequality. Take a look at the change in income inequality in France since 1983 below:

Change in income inequality in France 1983-2018

Source: Bozio et al. (2020).

Yes, redistribution through taxes and other means has helped reduce the increase in income inequality but it was not enough to compensate for the rapid increase in pre-tax income inequality (i.e. the effect that executives and highly skilled specialists got significantly higher wages while wage gains for workers remained low or negative). In the United States, the effect is even more pronounced:

Change in income inequality in the United States 1983-2018

Source: Bozio et al. (2020).

In summary, you can create two arguments for social policies here. First, Piketty and his co-authors argue that we should focus our policy discussion less on redistribution and more on reducing pre-tax income inequality. In my view, this could be done by increasing minimum wages or by capping salaries and bonuses for high earners.

Second, you can argue that redistribution via taxes, etc. hasn’t been effective enough in reducing post-tax income inequality. So, we need more redistribution and higher taxes on the rich to get things back to normal.

You heard it here first. Be prepared to have another debate fuelled by outrage and shock in the FT, Economist, WSJ, and whatever newspaper you read in a few years when Piketty has finished his next book.