Pitfalls of the inflation narrative

Few topics create as much debate at the moment in the world of economics as the question if we are going to see rising inflation or not. As you know, I don’t buy the argument that rising bank balance sheets and simple monetary and fiscal expansion are going to create runaway inflation.

But I still expect inflation to rise in the first half of 2021. That is a normal process after the end of every recession, but many people will jump on this development to argue that inflation is going to get out of control and will remain elevated for a long time. Over the weekend, the New York Times of all places had an excellent article on the four forces that are shaping inflation in 2021 and it should be recommended reading for every investor. In that article, the author claims that it will be hard to parse the different drivers of inflation, but I argue that with a somewhat different approach created by the San Francisco Fed that I have talked about before, it is possible to understand why inflation is rising and whether inflation is going to remain high or whether it is a short-term spike:

Demand-led Covid-sensitive inflation: This is driven by the change in prices of goods and services that suffered a significant decline in demand during the pandemic (think restaurants, sports and leisure, airlines, etc.). These goods and services have seen prices decline in 2020 and now see rising prices as businesses are able to hike prices up to pre-pandemic levels again. Of course, after a significant decline in prices in 2020, this return to pre-pandemic levels will look like a massive spike in inflation, even but it is only going to be temporary.

Supply-led Covid-sensitive inflation: This is the change in prices of goods and services that face supply shortages. Note that in the pandemic the production of some goods got delayed and halted. The result is that in some cases, inventories of customers are low and customers start to outbid each other to get access to the limited supply. In the early stages of the pandemic this was the rush to buy toilet paper and flour. Today, it is the low inventories of semiconductors and machinery that are a problem and that will force businesses to pay up for these supplies. Just like demand-led sensitive inflation, the rise in inflation for these goods and services is likely to be temporary because supplies can ramp up production and catch up with demand at which point prices will stabilise or even drop.

Covid-insensitive inflation: These are the prices for goods and services that did not experience material disruption during the pandemic. This component of inflation is in my view the best estimate we have to predict the long-term direction of inflation once we have come out of the recession and returned to a more normal state.

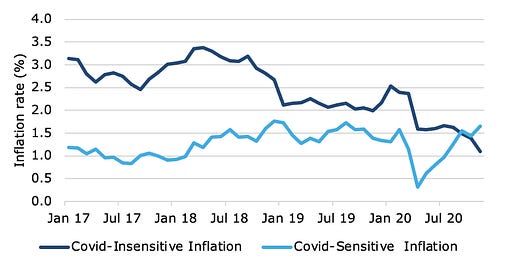

The chart below shows the most recent data for US Personal Consumption Expenditure (PCE) and the annual inflation rates for Covid-insensitive and Covid-sensitive inflation. While the annual inflation rate of Covid-sensitive goods and services is rising fast and quickly approaching 2%, Covid-insensitive goods experience disinflation and currently show an annual inflation rate of 1.1%.

Covid-sensitive and Covid-insensitive inflation in the United States

Source: Federal Reserve Bank of San Francisco

We can go even deeper into the world of Covid-sensitive inflation and separate the demand effect from the supply effect. The chart below shows the contribution of Covid-sensitive and Covid-insensitive inflation to PCE total (that is the annual inflation rate multiplied by the weight in the overall inflation basket).

Contribution to PCE inflation in the United States

Source: Federal Reserve Bank of San Francisco. Note: Ambiguous = inflation of goods and services that experienced both demand and supply shocks that led to an ambiguous outcome.

It is clear from the chart above that what we are witnessing at the moment is simply a return in prices of demand-sensitive goods and services to pre-pandemic levels. We also see first signs of slowly rising supply-sensitive inflation, but the contribution to overall inflation is minimal. What we will have to watch throughout 2021 and 2022 is if there are spillovers from Covid-sensitive inflation to Covid-insensitive inflation. And so far, we do not only have any sign that this is the case but see the exact opposite.