One of the most persistent complaints of investors about ESG investing is the lack of universal standards and ratings. Depending on the rating provider a company may be ranked as highly sustainable or very unsustainable depending on the methodology of the rating provider and what areas of ESG the provider emphasises.

This divergence between ratings may be defensible for overall ESG ratings where a plethora of dozens of metrics are combined. But it is really worrisome when rating agencies can’t even agree on the risk of companies in sectors in a narrow subfield. In the UK, every listed company will have to report its climate change-related risks and opportunities along the recommendations of the TCFD by 2025. The central part of this reporting is the estimated impact of physical risks from climate change. This encompasses things like floods in coastal areas affecting property, droughts, and windstorms damaging infrastructure, agricultural production and property, and the potential for increased costs due to construction delays or repairs.

In April, the European Commission endorsed the development of a Corporate Sustainable Reporting Directive that would cover all listed companies in the EU (c55,000 in total) and that would include physical climate risks as well as other risks.

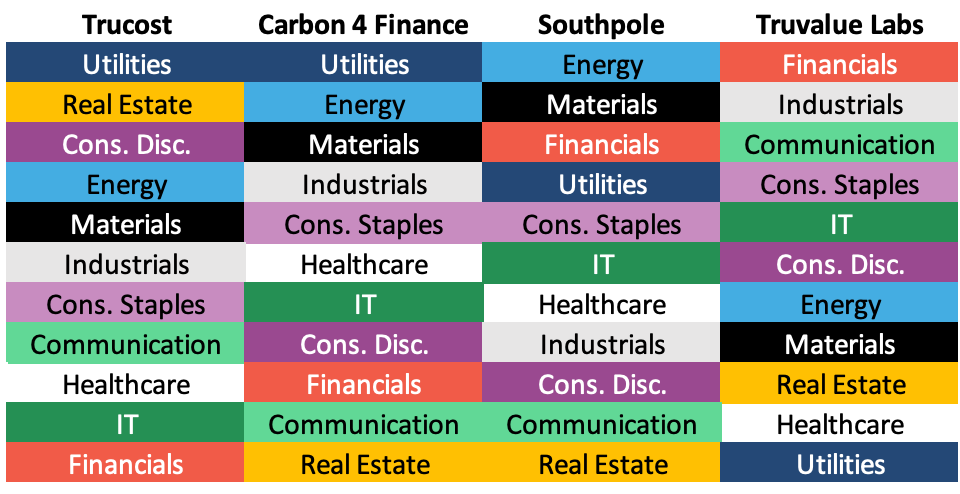

Given the fact that physical climate risks can be derived from Integrated Assessment Models which are freely available to everyone, one would think that assessing these risks should lead to roughly the same outcome across different providers. Assessment of individual companies may differ from one provider to another but at least averaged over a sector, one should see similar results. But as a team from the University of Zurich has shown, this is absolutely not the case. Comparing the physical climate risk exposure at the sector level across four commercial providers and two academic measures, they found a correlation close to zero between the physical risk rating of sectors. The table below shows the ranking of each sector by the four commercial vendors of physical climate risk.

How is it possible that utilities are considered to be most at risk from physical harm due to climate change by two vendors but least at risk of all sectors by Truvalue Labs? How is it possible that risks to Real Estate are generally considered low, except at Trucost which thinks that this sector is the most at risk of all sectors? None of this makes sense and it makes me angry that this is even possible. Just like we need Generally Accepted Accounting Practices, we need Generally Accepted Sustainability Practices. It is high time that regulators step in and stop this utter madness at ESG rating providers.

Physical climate risk ranking by four commercial vendors

Source: Hain et al. (2021).

GASP!! What a brilliant acronym (double entendre etc.)

Very topical article, as always. ESG investing is complicated matter, and even if we had some universal standards and ratings I agree with Warren Buffett on this when he said that "it is wrong for companies to impose their views on doing good on society. What made them think they knew better?" Besides, it should be matter for governments and not for private companies, whose primary responsibility should be to maximize the shareholder value. Moreover, aren't we running the risk of serious misallocation of private capital due to the push for ESG investing by various activist groups?