In the UK, many investors were hoping for more political stability after eight years of chaos after the Brexit referendum of 2016. Compared to the previous government, the new government has been less chaotic, though few would argue it has been a great government so far. At least we no longer change cabinet ministers every month which provides some additional economic policy stability. And this should lead to more foreign investments in the UK.

The Economic Policy Uncertainty Index developed by Steven Davis is now widely used as a measure of policy uncertainty in different countries. Several studies have confirmed that rising economic policy uncertainty (EPU) correlates with lower equity market returns and reduces investments in a country.

This was once again confirmed by Grace Qing Hao and Andi Li, who checked how economic policy uncertainty in 28 countries influences investment decisions of institutional investors. They found that an increase of the EPU index by 65 points reduces institutional ownership by domestic institutions by 0.13%. Almost all of that is driven by mutual funds while pension funds, endowments, bank trusts, etc. hardly change their ownership in domestic stocks in reaction to an increase in EPU.

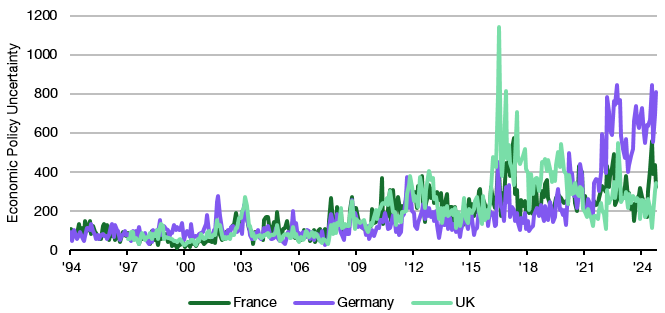

If you wonder how big a 65-point increase in EPU is, the chart below will give you an indication that this is pretty much the typical volatility of the index. The Brexit referendum in June 2016 increased EPU in the UK by 890 points compared to the start of that year, and the snap election in France last summer, increased EPU in France by 390 points.

Based on the baseline results, we would thus expect that British institutional investors have reduced their equity holdings by 890/65 x 0.13% = 1.2%. The snap election in France correspondingly might have reduced equity allocations by French institutions by 0.8%.

What is interesting about the new research is that it looks also at cross border investments and how an increase in the EU deters foreign investors from buying shares in a country. And here, the sensitivities seem to be larger. A 65-point increase in the EPU of the target country reduces institutional ownership of stocks in these countries by 0.28%. In other words, foreign institutions have likely reduced their holdings of UK stocks by 3.8%. Given that the UK is only about 3% of MSCI World it is probably fair to say that many foreign institutions sold all their UK stock holdings after Brexit. Similarly, the French snap elections have likely reduced foreign institutional ownership by 1.68%.

In that respect, I welcome the newfound policy stability in the UK, because it means that investors will gradually come back to UK stocks as they perceive the environment to be less risky than in the past. Germany and France, on the other hand, will likely continue to face outflows as long as they don’t get their act together.

Economic Policy Uncertainty in the UK, France and Germany

Source: Davis (2016)

Hey, thank you for the great insights. I have one question about the mentioned uncertainty for Germany: How can the graph show the uncertainty for the period after 2016 when the paper of Davis was published 2016? What calculus lies at the ground for that timeline (/prediction?)?