Politics distracts

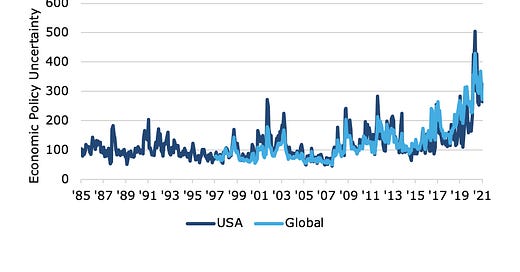

One of the best things of 2021 for me so far has been that the drama in Washington and other countries has declined so much. There is no more anxious scrolling through the news in the morning to see what the Tweeter in Chief in Washington has put into 280 characters overnight, or which shenanigans the EU and UK delegations in the Brexit talks have come up with next. It feels good to be able to focus on time frames longer than one news cycle again and think about the medium- to long-term developments for growth, inflation, etc. And lest some older readers say that we always had politics interfere with markets, let me show you the Economic Policy Uncertainty readings based on a textual analysis of news reports since 1985. Yes, in the past at least one thing was better than today: it was calmer on the politics front.

Economic Policy Uncertainty Index

Source: Davis (2016), Baker, Bloom, and Davis (2016)

As I say in my book on geopolitics for investors on several occasions: Most geopolitical events don’t matter for investors. It is critical to understand the few instances where politics matters and ignore when it doesn’t.

But according to a study by researchers from the University of Amsterdam, most analysts and investors aren’t able to do that. They showed that when economic policy uncertainty is high two things happen. First, analysts disagree more in their views about companies and their prospects. This isn’t too surprising since uncertainty about politics should filter through to uncertainty about the future growth of companies etc. But there is another effect as well. When companies do report their earnings, uncertainty should be reduced and this reduction in uncertainty should lead to higher adjustments in share prices after an earnings surprise when policy uncertainty is high. Yet, the opposite seems to happen. When economic policy uncertainty is high, investors react less to earnings announcements even though the reduction in uncertainty by presenting results is greater in this environment than normal. What happens is that in times of high economic policy uncertainty, investors get distracted and simply react less to fundamentals. In a sense, it is easier for bubbles to form when economic policy uncertainty is high and it is easier for markets to follow fundamentals when it is low. Investors should welcome the decline in policy uncertainty this year because while it may not pop every mispricing in markets today, it at least makes it possible for more investors to focus on what is and isn’t out of line with fundamentals.