By now it is fairly well known amongst investors that there are substantial differences in the returns of stock markets during the day and overnight when markets are closed. At night, the market return is defined by the difference between the last day’s closing price and the next day’s open. But this price difference is not driven by actual trades of investors but predominantly by the news flow overnight. So, if the news is the only or at least the main influence on prices overnight, shouldn’t markets be more rational at night and be more sentiment-driven during the day?

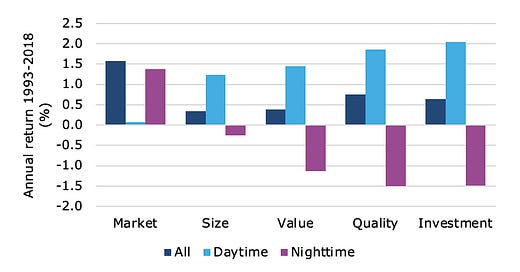

To test this, it is worthwhile to look at the return components of stocks during daytime trading and overnight as Austin Hill-Kleespie has done. He looked at US stocks from 1993 to 2018 and split up the performance of each stock not just between daytime and nighttime returns but also along the lines of the Fama-French four-factor model. In that model, returns are split up between the CAPM market return, the size and value factor, as well as the profitability (quality) factor, and the investment factor. And this split shows that the CAPM market factor is predominant during the night and nonexistent during the day. In other words, the CAPM describes a market where no human investor is involved.

Factor returns during day and night

Source: Hill-Kleespie (2021)

Meanwhile, all the different deviations from the rational model of CAPM appear during the day. Size, value, quality, and investment factors all have very high returns during the day when humans mess up all the nice rational models economists have developed. At night, these factors tend to lose a bit mostly because the stocks that have underperformed during the day catch up some performance based on the overnight news. But the nighttime setbacks aren’t strong enough to eliminate factor returns.

This shows once more that modern portfolio theory is an incomplete theory because it ignores the human element of markets. And as long as humans are going to invest, CAPM and other models will never be an accurate description of markets. They need to be complemented by an analysis of how humans think and act in markets to fully understand the returns of stocks over time. But just looking at the human side of markets alone won’t succeed either. By doing that, one ignores the reaction to fundamental news overnight, which is a substantial contributor to returns as well.

In short, successful investors need to be able to analyse both the fundamental/rational side of markets as well as the human/irrational side of them.

Boss, I'm not coming to work today - I'm staying in bed. Don't be cross, I'm trying to help the markets.