Regulation as a driver of investment risk

Yesterday, I wrote about how investors should not let their politics influence their investment decisions because the market does not care about your political views. However, this does not mean that politics don’t matter. Political decisions can have a significant influence on stock market returns.

Baris Ince and Han Ozsoylev have shown the influence of politics on financial markets from a fascinating angle, focusing on something that in the past was often discussed but hard to quantify: Government regulation.

Business leaders and investors know that increasing regulation leads to rising costs for businesses. Some of these costs are fixed, like the need to keep records and report data to supervisory bodies. Other costs are variable, such as the need to pay government inspectors based on the amount of goods produced or the number of clients serviced. And then there are indirect costs to regulation like lost business or discouraged investments due to excessive regulatory hurdles.

Thanks to modern text analysis tools, we can now get a much better understanding of the number and type of regulations different industries and businesses are subject to. The new research then focused on a potential source of risk for businesses introduced by these regulations, the fixed cost overhang created by them.

If a company faces higher fixed costs due to increased regulatory demands, this introduces additional risks to the profits and cash flows of the company in the form of additional operating leverage. The thinner the margins of a business, the higher this regulatory operating leverage (ROL) because profits can evaporate quickly if revenues slow. The chart below shows the average ROL for US companies since 2000.

Median regulatory operating leverage of US businesses

Source: Ince and Oszoylev (2024). Note: Shaded areas indicate recessions.

It is clear from the chart that regulations come in waves, typically after a recession or economic crisis. We can see three periods of rising regulatory leverage. One in the early 1990s in Bill Clinton’s first term, one after the corporate scandals of the early 2000s under George W. Bush, and another one under Obama in the aftermath of the financial crisis. These regulatory drives are then followed by extended periods of deregulation and declining ROL, e.g. in Clinton’s, Bush’s, and Obama’s second term in office and under Donald Trump.

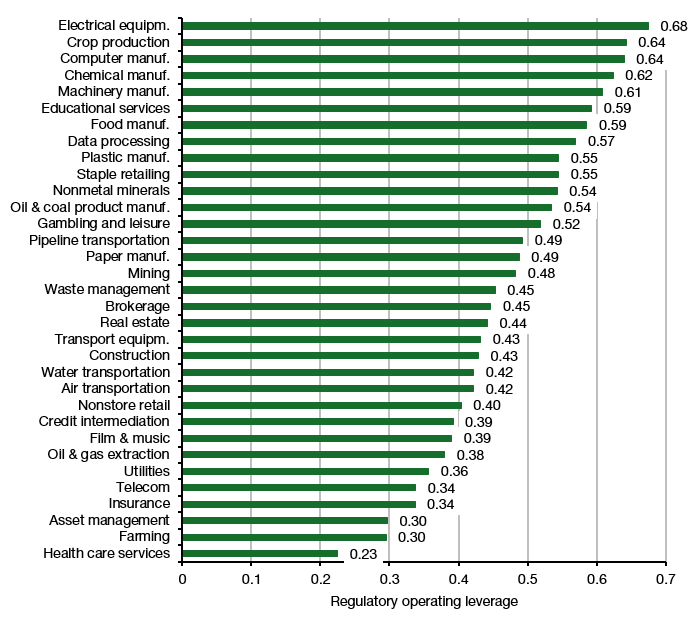

However, not every industry is subject to the same ROL. Here is a chart of the average ROL by industry in the US. In general manufacturing businesses tend to have the highest ROL, whether it is electrical and electronic equipment, machinery, chemicals, or food and tobacco. The financial services industry and services in general tend to have relatively low ROL mostly because regulatory requirements for services focus on record-keeping which is relatively cheap and because services businesses tend to have higher operating margins and thus lower operating leverage.

Surprisingly though, oil & gas extraction and mining also have relatively low ROL, even though I would consider them to be subject to some strict regulation.

Median ROL by industry

Source: Ince and Ozsoylev (2024)

If regulatory requirements are a source of risk, this risk should be rewarded in financial markets in the form of higher returns. After all, profits of companies with high regulatory operating leverage can disappear quickly if revenues slow or if additional regulation is passed that increases the already high fixed costs to comply with regulations.

Indeed, companies with higher ROL tend to outperform companies with lower ROL. This outperformance is particularly pronounced for smaller companies that lack the economies of scale of their larger competitors.

Risk premium associated with higher ROL

Source: Ince and Ozsoylev (2024)

On the one hand, this research confirms only something we already know. More regulation increases costs and reduces profits. But what it also allows us to do is focus on businesses with higher ROL where (de-)regulation has an outsized impact on share prices. And apparently, most of them can be found in classical manufacturing and industry.