Risk is path dependent

Yesterday, I discussed how both laypeople and finance professionals assess the riskiness of an investment the same way. More importantly, changing the volatility of an investment did not materially change the perception of risk. What did influence the perception of risk was the skewness of an investment. Investments with positive skewness, i.e. payoffs like a lottery with many small losses and potentially large gains, are perceived as less risky than investment with negative skewness.

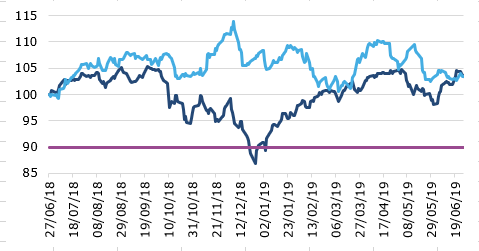

This finding fits neatly with one of the most important features of risk that is commonly overlooked by investment professionals: our perception of risk depends on the circumstances. Take a look at the chart below. It shows the development of two investments over one year. Both investments have the same return and the same volatility, but one investment (the dark blue line) has negative skewness while the other (light blue) has positive skewness. If I would ask you to tell me which one of the two investments less risky, I suspect most people would say that the second investment has lower risk – at least that is what the paper I cited yesterday has shown.

However, in my experience as someone who has dealt with private investors for many years, the true challenge of the second investment is not just that it is perceived to be riskier, but the path it takes to get to the same end point. In a new paper, Charlotte Borsboom and Stefan Zeisberger showed that investors, when they assess the riskiness of an investment look at salient points like highs and lows and the dynamics between them. If the investment shows a significant decline like the dark blue line in our chart, it is perceived as riskier. Furthermore, the dark blue line temporarily drops below a psychological threshold (in this case a loss of 10%), which is when some investors start to panic. The panic usually gets reinforced by media coverage. Once the stock market drops by more than 10% from a recent high, the media coverage starts to talk about correction and once it drops by more than 20%, the coverage talks about a bear market. And this media coverage reinforces the pain felt by investors and pushes them towards selling the investment.

Thus, a financial adviser has to constantly push against a confluence of factors that reinforce each other and create a sense of urgency to act in the face of a short-term downturn. This is what investor education should focus on, in my view. Getting an investor to understand volatility and the basics of stocks, bonds and diversification is important, but educating a client on the impact of situation under which a loss or gain is achieved is likely to have a higher rate of success than an education in finance theory. If an investor has a set of tools to recognise how recent short-term returns, media hype or even stress in the job or family trouble can impact investment decisions, she is more likely to avoid costly mistakes in her portfolio than if she knows the basics of modern portfolio theory or any other abstract concept of finance. Providing these tools to increase situational awareness is a key task for financial advisers – and an added value that is hard to be replicated by robo-advisers or other low-cost competitors.

The tools that achieve these goals are varied. Visualisations of hypothetical or historical episodes in financial markets that can be discussed to make investors aware of path-dependency are a good starting point. Putting short-term episodes in financial markets into a long-term context, consistent with the investors time horizon is another important tool. And in a 2012 paper for the Journal of Wealth Management, Robin Miranda and I have introduced a few simple tools that advisers can use to elicit how personal experiences influence investment decisions of an investor and that enable investors to put their current mood and impulses into a broader context. Finally, I am intrigued by the potential of psychological techniques such as mindfulness and meditation to increase situational awareness. In my view these techniques could be useful tools for investors as well.

Two investments with the same return and volatility but different paths

Source: Bloomberg.