Robinhood traders are patsies

In his 1988 letter to shareholders, Warren Buffett helped popularise a saying that was known before he used it in his letter:

“As they say in poker, ‘If you’ve been in the game for 30 minutes and don’t know who the patsy is, you’re the patsy.’”

When I wrote about the GameStop bubble and how unsuspecting traders on zero-cost platforms like Robinhood would be taken advantage of by professionals, I got a lot of angry comments from what I presume have been novice traders who bought into the story of the stock and the promotion of it by people like Elon Musk. By now, GameStop shares are down more than 90% from their intraday highs on 28 January 2021 and once more, novice retail investors had to pay “school fees”. There is nothing wrong with that. I have paid my “fees” more than 20 years ago in the tech bubble of the late 1990s. If they are willing to learn from their GameStop experience, they will become better investors over time.

Back in that day, the media was also asking whether this army of retail traders can influence the markets and whether the markets overall have changed. By now, the evidence is piling up that the answer to this question is a clear no.

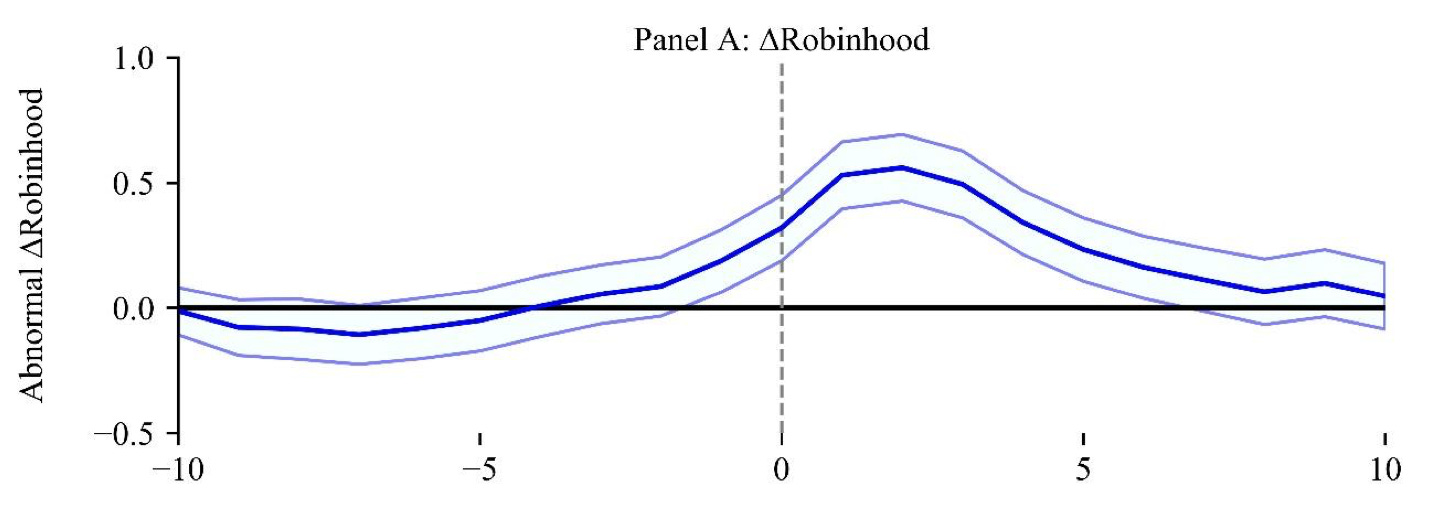

In January, Gregory Eaton and his colleagues published a research note on the impact of Robinhood traders on the stocks they invest in. They looked at the link between the now-famous Reddit forum WallStreetBets and Robinhood trades as well as retail trades overall. In order to figure out the impact of Robinhood traders on the stock market overall, they used the trading outages the app had throughout 2020 to compare the share price volatility and liquidity in times when Robinhood traders could not trade compared to when they could.

Using 5-minute intervals they showed that Robinhood traders don’t provide liquidity or make markets more efficient. Instead, markets became more efficient when Robinhood was down. In those times when the app was down the effective spread of the stocks most traded by Robinhood users declined by c.6bps while volumes also settled down.

More importantly, they showed how the flows in the retail market worked. What they found was that hype about stocks on WallStreetBets followed general inflows by retail traders from all kinds of platforms by a couple of days. And then it took another couple of days until Robinhood traders picked up on the hype and bought the stock on the app. The result was that Robinhood traders bought a stock about a week after the average retail trader bought it. And while there is a statistically significant increase in share prices in the three to five trading days after retail traders buy a stock, there is no predictive relationship between Robinhood traders buying a stock and its subsequent return.

That is the very definition of being a noise trader. Robinhood traders react to short-term noise and distort share prices but have no discernible investment edge or impact on the market.

Trading volume around days of hype in WallStreetBets forum

Source: Eaton et al. (2021).

The outcomes in terms of investment performance for Robinhood traders are correspondingly poor. Brad Barber and his colleagues have investigated the performance of Robinhood traders throughout 2020 using similar techniques and they found that the users of the app significantly underperformed the S&P 500 by about 5 percentage points for every trade they make. Turns out that traders on Robinhood don’t revolutionise the market. They are instead the patsies on the table…

Performance of Robinhood traders vs. S&P 500

Source: Barber et al. (2020).