In recent years, we have seen more and more companies from Europe and the UK choose a cross-listing in the US or move their listing across the pond entirely. The most common reason cited for this move is the higher valuations achieved for shares, but another issue sometimes mentioned is the overregulation in the ESG space.

I think ESG regulation has gone too far in Europe, and it needs to be relaxed somewhat. And I am glad to see that both the UK and EU regulators are currently sounding out ways to improve regulation. But we should not water down regulation to the very low standards in the US because over there, ESG regulation is ineffective, in my view, even with the new SEC disclosure requirements for climate risks.

Moritz Wiedemann from Imperial College London has published an interesting study that investigates the link between cross-listing in the US and sustainable capex of European and Asian companies. In particular, he exploited the difference in pressure from institutional investors together with the difference in regulation.

As of 2021, 30.6% of equities in Europe are held by institutions that are also signatories of the Climate Action 100 initiative, compared to 25.4% in Asia and 18.8% in North America. This means that if a European or Asian company chooses to cross-list its stocks in the US, it will dilute its ownership of sustainable investors and face less pressure from investors to act on climate risks.

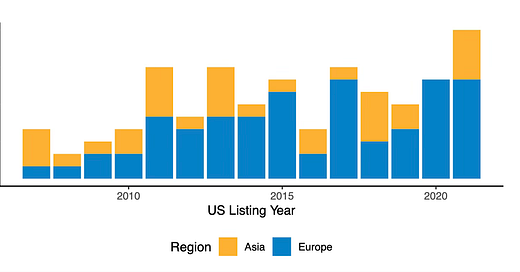

Number of companies from Europe and Asia choosing to cross-list in the US

Source: Wiedemann (2024)

Using these companies as Guinea Pigs, he was able to show that cross-listing in the US reduces a company’s issuance of green bonds and sustainable investments in its business. The result is a gradual increase of scope 1 greenhouse gas emissions (these are the emissions the company creates itself as part of its operations) in the years after the cross-listing.

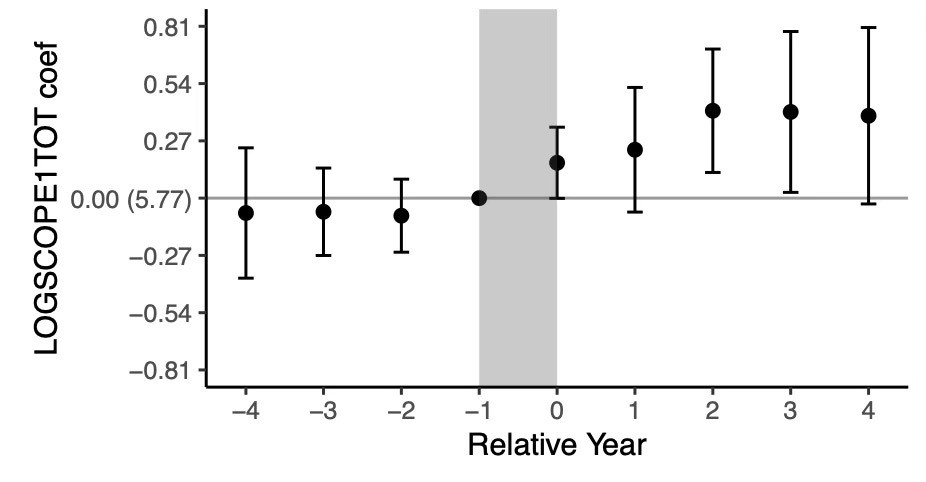

Increase in scope 1 emissions of companies after cross-listing in the US

Source: Wiedemann (2024)

The increase in scope 1 emissions is not small. The effect of cross-listing in the US is at least the same in size as the effect of introducing a carbon tax on companies – just with the opposite sign. In other words, companies that cross-list in the US act as if the carbon tax in Europe (which more and more companies in Europe must pay) had been repealed and they could pollute the world some more. High time then that the US introduces ESG regulation and carbon taxes equivalent to European standards.

Lots and lots of demand from US investors for sustainable and positive impact investing in my experience. It's a bit of a misnomer that there isn't. Providing carrots (tax breaks etc.) rather than sticks (taxes and fines) for companies tends to work better in the US. 'Big government' tends to be more welcome when it is a friend.

Re re-listing / dual listing.. I think the part of that trade non-US companies often forget to factor in when they chase a higher multiple (especially in smid cap land) is increased volatility. Much faster money. Would be interesting to see a study on that.

You think Europe has gone too far but "High time then that the US introduces ESG regulation and carbon taxes equivalent to European standards."?

Alternately, Europe has gone too far & fortunately the US has not, at least not yet.