Every experienced investor knows that the thought processes of short-term and long-term investors are very different. Short-term investors focus more on market technicals while long-term investors focus more on fundamentals. But the more they differ, the more volatile markets can get.

Anthony Cookson and his colleagues analysed the stock predictions of retail investors on Motley Fool’s CAPS platform. And while retail investors act differently from professionals, there are still some universal lessons that we can take from their analysis, in my view.

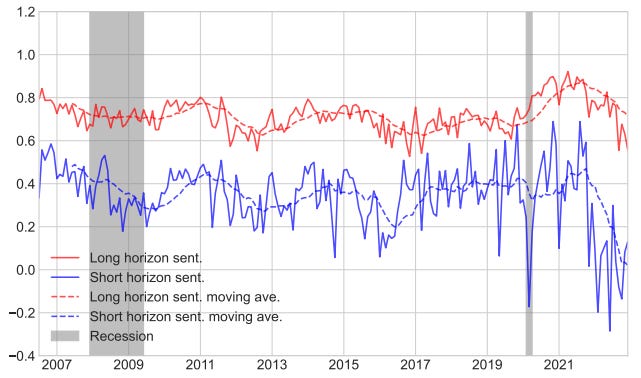

First, look at the average sentiment (standardised between 0 = everyone is bearish and 1 = everyone is bullish) for short-term investors (investment horizon of three weeks or three months) and long-term investors (investment horizon of one year or longer). As you will undoubtedly notice immediately, long-term investors tend to be more optimistic on average and their sentiment changes more slowly than that of short-term investors.

This is even the case during major market turmoil. During the Covid pandemic in 2020 and the financial crisis (grey bars), long-term investors kept their cool and sentiment hardly changed. Short-term investors, meanwhile, saw a rapid decline in sentiment. In 2022, when inflation rose substantially after the Russian invasion of Ukraine, sentiment declined for both long-term and short-term investors, but again more aggressively for short-term investors.

Sentiment of short-term and long-term retail investors

Source: Cookson et al. (2024)

On a micro level, we can observe the same divergence between short-term and long-term investors around earnings announcements. The chart below shows how short-term and long-term investors update their share price forecasts in reaction to positive and negative earnings surprises. Once again, the short-term investors react more aggressively and always in the direction of the earnings surprise. They are effectively playing the earnings momentum. Long-term investors, meanwhile, hardly change their share price forecasts in reaction to a single earnings announcement and are much more focused on valuation and other long-term factors.

Reaction to earnings surprises and investment horizon

Source: Cookson et al. (2024)

These differences in sentiment shifts are what is driving trading volume in the affected stocks. The bigger the difference in sentiment between short-term and long-term investors the higher the trading volume in a stock and the more volatile share prices can become.

In a sense, and probably without realising it, long-term investors tend to take the opposite side of the trade of short-term investors after earnings releases or during periods of market stress like the financial crisis or the pandemic. And one doesn’t need to be a financial historian to figure out who, on average will be better off between the two groups. I, for one, wouldn’t bet my money on the hyperactive short-term crowd.

"During the (...). financial crisis, long-term investors kept their cool and sentiment hardly changed".

I'd like to know what that means. Professionals weren't worried during the GFC? Holy cow, if they didn't get worried then, what would it take? A combined asteroid strike and a megatsunami?

Never mind the lols, I indeed find it interesting that the smart money -- the bond traders -- weren't worried about the GFC until rather late in the game. At least, that's what $DJCB the Dow Jones Corporate Bond Index indicated, with no meaningful price deterioration until around July 2008, by which time the SPX had almost lost 20%. On the other hand, hi-yield was quite a bit jumpier, with option spreads broadening about a year earlier.

From my vista, it seems there might be a lot of variance in the "long-term" crowd.

My journey as an investor, skipping over an initial disengagement post dot com bubble has been one of restraining impulsiveness. In other words moving from short term trading to long term investing. I am now sanguine and trust in the process.

I moved from profiting from trading ranges, through bias towards Asia and small caps (buying narratives), value investing (Russia!), tinkering, big name fund managers, to finally arrive at a fixed asset allocation between MSCI World and an even split of domestic government bonds and currency hedged treasuries all as low cost ETFs. I wish I hadn't had to learn the hard way.

Looking back my real mistake had been wanting to outperform or "seeking an edge". If I had trusted that not losing would be the best outcome I could secure for certain I would be richer today. As it is the market has been kind to me, my terrible mistakes were offset by learning lessons and a lucky pick of a newly launched "Fundsmith" as my last active play and going fully passive as Mr Smith peeked, and I have a comfortable early retirement.