Should the US introduce a carbon tax?

After ten years of preparations and several delays, China is launching its national emissions trading scheme this summer (at least that is what is expected as I write this…). In the European Union and in the UK, we have a carbon emissions trading scheme in place for the biggest polluters since 2005, so that now, only the United States is missing amongst the three major blocs of greenhouse gas emitters.

And while there are several smaller schemes in place in different regions of the United States, there is still substantial uncertainty if the country as a whole will put a mandatory price on carbon either in the form of an emissions trading scheme or a carbon tax. And that may be a problem.

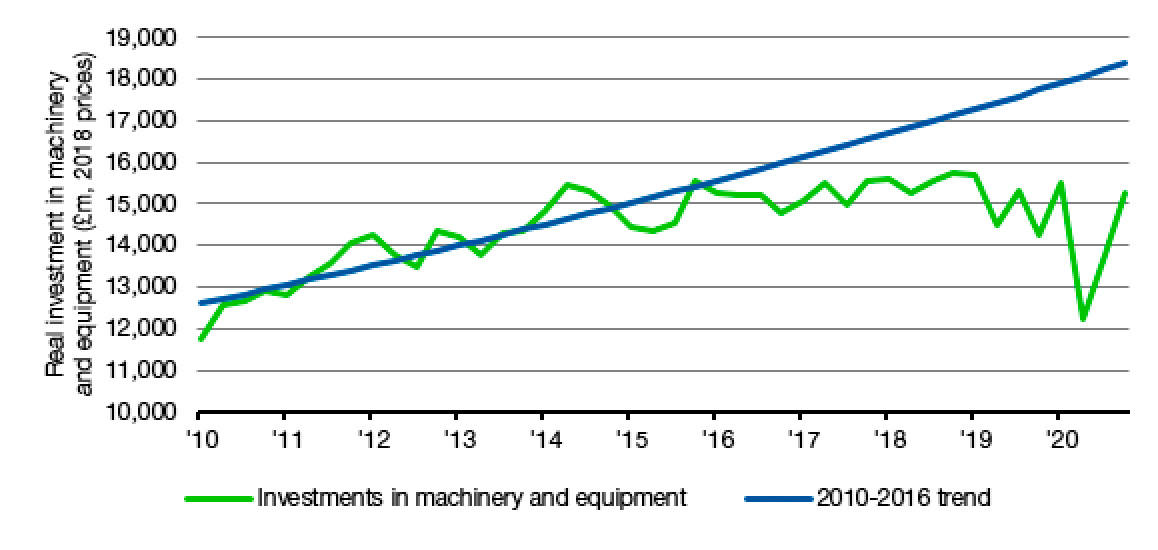

Here in the UK, we have just come out of a period of five years of uncertainty about the implications of Brexit. And the uncertainty about the future terms of trade with the EU has caused significant problems for the economy already. The chart below is one that I have been using for the last year or so when talking about capital expenditures of UK businesses. It shows the investment in machinery and equipment together with the pre-Brexit trend. Once the referendum was held and it became clear that the UK would leave the EU, businesses held back additional investments because they didn’t know what the future relationship with the largest export partner would look like. They continued to maintain machinery and equipment, but growth was absent for five years. And to top it all off, in 2020 a massive pandemic hit. But at least now that the UK has left the EU, it is clear what the rules are and there is a substantial investment boom in the UK which is essentially a catch-up with five years of missed investments.

Investment in machinery and equipment in the UK

Source: ONS

And if you ask me – and the economists at the San Francisco Fed – the uncertainty around the price of carbon is holding back investment in the United States as well. If you are running a steel mill in the United States, or a cement factory, etc. the biggest unknown for you may be the possibility of having to pay a carbon tax in the future. Your company may be able to compete with foreign makers of steel and cement if there is no carbon tax, and it may even be able to compete if there is a low price of carbon of, say $20 or $40 per tonne. But it may not be able to compete if the price of carbon is $100 per tonne. Personally, I think the price of a tonne of carbon emissions should be around $100 per tonne, but the political reality is that it will be lower in practice, no matter which party is in charge in Washington.

But the thousands of businesses that would be impacted by a carbon tax or a national emissions trading scheme don’t know what the price of carbon would be and when they would be subject to it. And given that uncertainty, projects that have too narrow a margin of safety will simply not be built and investments will be held back. And this means that by keeping businesses in limbo, the US is missing out on jobs and growth. Better to get on with it and follow the example of Europe and China where emissions trading schemes have if anything, caused domestic companies to become more efficient and productive and internationally more competitive.