Show me your playlist and I tell you how you invest

Normally, I write about sustainable investing only on Mondays, but I came across this study, which is simply too crazy to be taken seriously. Essentially, it shows that academics with too much time on their hand and armed with an Excel spreadsheet can be fun to read – though you definitely shouldn’t trust their recommendations in these cases.

But let’s get back to basics. ESG investing is a hot topic, and we all want to figure out why some investors are not only interested in sustainable investments but may in some cases be willing to forego significant returns to do so. One way this problem can be approached is by looking at the correlation between personality traits and the willingness to invest sustainably. That may make some sense, but in the study mentioned above, the authors went beyond this simple link between personality traits and the desire to invest sustainably.

They thought, how do we figure out what personality traits an investor has if we can’t subject him or her to a full personality test? “Ah”, they said – presumably with a German accent because the study was done in Germany – “we ask them what kind of music they listened to and what kind of drink they like.” Then they went into a lecture hall and recruited a bunch of business students and asked them these questions and let them choose several times between four different funds with different risk profiles. Two of the funds were sustainable investment funds, while the other two were not.

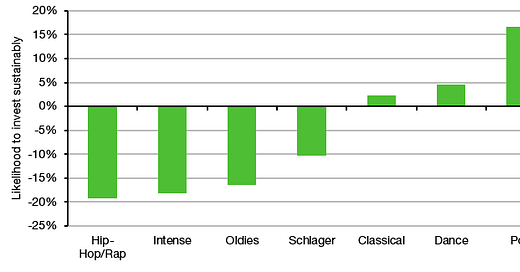

They typed the responses into their spreadsheet and fitted a logit function to estimate how likely different groups were to invest sustainably rather than conventionally. After a while, they came back and said: “As we can see in the chart below, students who listen to pop music or dance music are more likely to invest in sustainable funds while students who prefer rap, oldies or German Schlager are less likely to do so.”

Music preferences and sustainable investments

Source: Kleffel and Muck (2022)

Then they went back to work, did the same exercise with drinking habits and compared it with beer drinkers as a reference point (these are German students after all). They came back with the chart below and said: “students who drink hard alcohol and cocktails are less likely to invest in sustainable funds while connoisseurs of wine and non-drinkers prefer sustainable investments.” Why? The authors make some arguments about how music preferences and drinking habits are linked to certain personality traits, but I would say, the main reason why they find these results is that if you collect a bunch of noisy data, put them into an Excel and fit any function, you will inevitably get some random order of results some of which will even be statistically significant. But that doesn’t mean that you – or anyone else – should believe these results. It just means that there were a couple of academics with too much time on their hands…

Drinking habits and sustainable investments

Source: Kleffel and Muck (2022)