Small, Value, or Small/Value?

In the more than five years I have been writing these daily posts, I cannot recall a single instance where I came across a note that is both so short and succinct, yet so valuable that I was tempted to copy and paste the entire thing. However, Javier Estrada has managed to write a highly instructive note that requires minimal input from my side. For one, I have simply copied his title.

His research question was quite simple. If an investor wants to add value and a small-cap tilt to an existing broad-market equity portfolio, is it better to add a value fund and a small-cap fund, or one small-cap value fund?

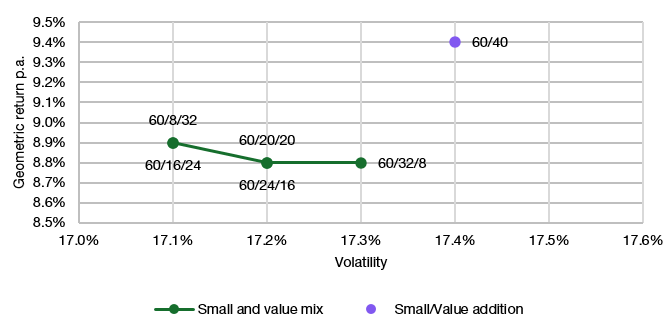

He examines the question using the long-term data available on Ken French’s website as well as the real-life data from three ETFs available since 2000. Let me show you the results for the ETFs between 2000 and 2024. The chart below shows the risk-return profile of a portfolio that is invested 60% in the S&P 500 and 40% in the S&P Small Cap 600 Value ETF. Then it compares the result with a portfolio that is invested 60% in the S&P 500 and varies the remaining 40% between an S&P Small Cap ETF and a S&P US Value ETF.

Risk-return trade-off for small-cap, value, and small-value tilts

Source: Estrada (2025)

The results in this case indicate that adding a small-cap value fund is better for the investor than adding a mix of a small-cap and a value fund. Although the small-cap value fund has higher volatility, and thus the overall portfolio volatility is also higher, the return advantage of having a more concentrated small-cap value allocation outweighs this cost in both absolute and risk-adjusted terms.

While I don’t have any data to back this up, this confirms my suspicions that, in most cases, having one investment with the desired combination of factors is better than mixing a couple of different factor exposures. The more focused approach of one multifactor addition removes duplications and noise from stocks that are small-cap growth and are part of the small-cap portfolio. Similarly, the value portfolio includes both large-cap and small-cap stocks, thus replicating more of what the investor already has in the S&P 500 market portfolio and reducing the diversification benefits. In short, if you want to have a specific factor exposure, it is probably best to look for a single product or manager who combines all the required factors in one unified approach.

Introspection coupled with Serious Analytical Diagnosis. It adds life time Values for high "RETURNS".

Wow - making a generalized, forward-looking statement based upon four or five years of "historical" data!