Southeast Asia as the new ESG investment hub

The world is starting to split into two trading blocs. This forces companies in the US and Europe to friend-shore some of their production and move it from China to other countries. In my discussions with business leaders, Southeast Asia came up several times as an ideal place to move production facilities. Now, some data shows that the region indeed increasingly benefits from investments, particularly in green technologies.

The energy transition to renewables is a major problem because China dominates the markets for key commodities needed in the space as well as the supply of key products such as solar cells, batteries, etc. And as we all know, China and the Western world are increasingly at odds with each other about trade practices, political vision, etc.

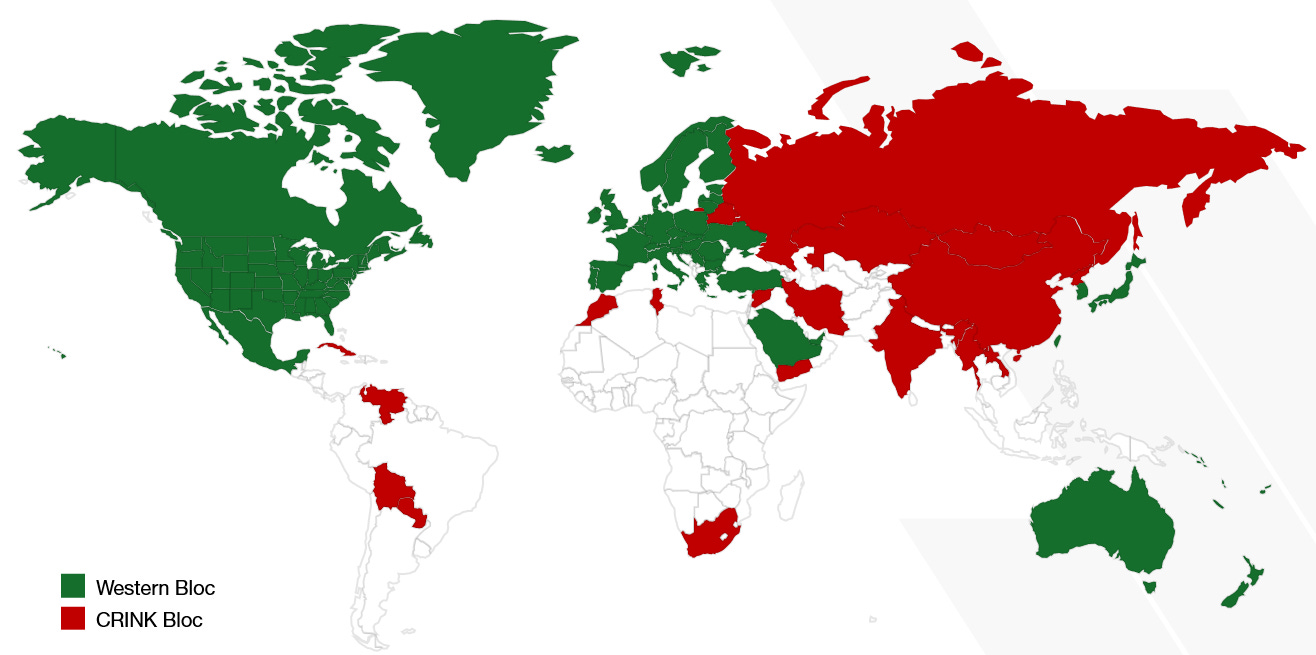

The chart below uses research from the European Bank for Reconstruction and Development to identify which countries are part of which bloc based on their voting behaviour in the UN General Assembly. In green, we have the Western Bloc under the leadership of the United States, which comprises practically all highly developed industrialised nations. In red, we have the CRINK Bloc named after its key members China, Russia, Iran, and North Korea.

Geopolitical fragmentation based on UN votes

Source: Javorcik et al. (2022)

Much of the world is currently unaligned between these two blocs, though most countries lean toward either one of them. For example, while Latin America is largely unaligned, countries like Chile or Uruguay are probably leaning more toward the Western Bloc, while others are probably more CRINK-leaning, though not clearly as much as Venezuela, Bolivia, or Paraguay.

One unaligned region is Southeast Asia, which boasts a relatively high degree of development but still quite low labour costs. This makes it an interesting investment proposition for Western companies that want to diversify their supply chains away from China.

Two researchers from the National University of Singapore analysed venture capital investments in the Asean region to assess if these countries benefit from their unique position in a fragmenting world.

They found that especially in areas that are related to the energy transition, there is an increasing specialisation in the venture capital market in Southeast Asia. The chart below shows the Revealed Industry Advantage (RIA) in investments in green technologies for the six Asean countries and a couple of benchmark economies. The RIA essentially measures how much venture capital investments are focused on the technologies in question relative to the global average.

Industry specialisation in venture capital investments

Source: Liu and Sengstschmid (2024)

Thailand, Vietnam, Malaysia, and the Philippines are key beneficiaries of the increasing geopolitical fragmentation. Though, different countries seem to specialise in different technologies. Vietnam is increasingly a hub for investments in electric vehicles, while Thailand and the Philippines dominate in solar cell manufacturing and other renewable energy technologies.

The study concludes that there are a host of reasons why these countries are preferred investment targets. As I have mentioned above, these countries still have relatively low labour costs but an increasingly educated workforce. Plus, these countries have connections to both the West and China, thus enabling them as intermediaries for global supply chains. Finally, these countries tend to have relatively stable political systems, making investments easier. And if you ask me, as long as these advantages persist, Southeast Asia has a bright future.