Sustainability-linked loans with room for improvement

Sustainability-linked bonds and loans have become very popular with businesses because they allow them to link their cost of debt to their performance on specific ESG measures. Not only does that reduce their cost of debt (better ESG performance typically leads to lower interest payments), but it also acts as a signalling tool to investors that the company is serious about its efforts to make the business more sustainable.

As an economist, I am trained to think in terms of incentives. And sustainability-linked bonds and loans not only align the incentives of company executives to the wider goals of enhancing the business, but they do so in a clear and measurable way. So, as you might guess, I think these instruments are great.

But we also have to be realistic that these bonds and loans are relatively new. The criteria for what qualifies as a sustainability-linked bond have only been finalised in 2020 while the loan principles exist since 2019. This means that businesses and advisors still try to figure out what the optimal key performance indicators for these bonds and loans are.

A team from the University of Giessen in Germany have analysed 214 sustainability-linked loans and scored the degree to which these loans have used KPI that align with crucial business measures:

Are the KPIs of the loans aligned with either the published Sustainability Strategy of the business or the corporate strategy overall?

Are the KPIs of the loans material to the industry in which the business operates?

Are the KPIs measurable and quantifiable?

Can the KPIs be benchmarked against taxonomies, regulatory requirements or industry peers?

Do the KPIs influence interest rates in both positive and (crucially) negative ways? If so, how sensitive are rates to KPIs?

Are the KPIs subject to third-party verification?

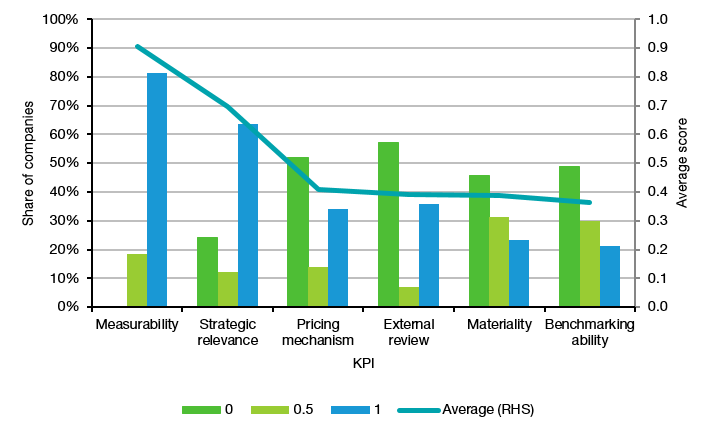

In every dimension, companies could get a score of 0 (not met), 0.5 (partially met), and 1 (fully met). The chart below shows the share of companies for each score and each dimension as well as the average score in each dimension.

How well do sustainability-linked loan KPI match crucial goals of the business?

Source: Auzepy et al. (2022)

The good news is that sustainability-linked loans tend to be well-aligned with the strategic goals of a business, quantifiable and measurable. But then it gets murkier.

The pricing mechanism for the loans is typically not developed well enough. In my experience, the major problem here is that the link between KPIs and the interest rate paid in the loan is weak. Beating the KPI target often reduces the cost of the loan by just a few basis points. A bigger leverage and a stronger reduction in interest cost if KPI are met would be desirable.

Also, sustainability-linked loans are often linked to KPI that may not be material to the industry a company operates in. This typically happens when a company links its loan to the reduction of greenhouse gas emissions but operates in an industry like software development or professional services where greenhouse gas emissions are in any case so small as to be immaterial.

And finally, there is a lack of comparability of the KPI. Typically, KPI for sustainability-linked loans are equipped with benchmarks that are designed by the issuer of the loan together with the company, but without much thought to how these KPI relate to the EU Taxonomy or how they can be compared to national net zero targets, for example. Again, a better design would be desirable.

As I said, we are at the early stages and there is much room to improve. But I think over time, we will see improvements as the application of the standards becomes more mainstream and businesses and lenders alike become more comfortable with these new instruments.