Tax havens…

Tax havens, man. There are plenty of legitimate reasons for people to move their money to offshore tax havens, for example to protect their assets from an autocratic regime or potential expropriation. And of course, there is nothing wrong with legally reducing your tax burden. But when tax havens help criminals and people subject to international sanctions hide their money it crosses a line. And unfortunately, that is what they are doing.

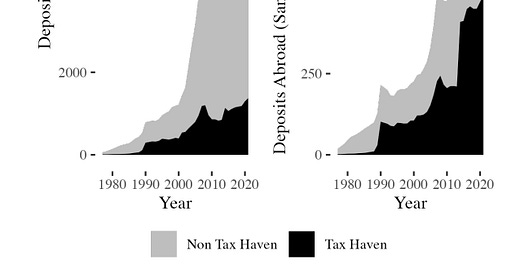

A new analysis from Bocconi University and Newcastle University shows just how much people who are subject to international sanctions for corruption, drug trafficking, terrorism financing or supporting a rogue regime use tax havens to hide their money. Below is a chart that shows the deposits held in foreign bank accounts split between tax havens and non tax havens. On the left we can see that tax havens hold only about a fifth of total foreign assets when looking at all depositors. But when we restrict the depositors to those who are subject to international sanctions (e.g. Russians, Syrians, people linked to criminal activities and terrorism, etc.) then the picture changes dramatically. Suddenly, about half of all assets are held in tax havens.

Total foreign deposits over time

Source: Kavakli et al. (2023)

Indeed, the researchers could show that when a person becomes sanctioned, he or she is moving assets away from non tax havens and into tax havens to reduce detectability to prosecutors. And the banks and trust companies in tax havens seem only too willing to help.

But there is also good news in the research. Apparently, it makes a difference if the US leads the sanctions. If the US participates in the sanctions, there is no change in this trend to hide assets in tax havens and tax havens have no qualms helping sanctioned persons evade sanctions. But if the US leads a sanction regime (for example against people indicted under the Magnitsky anti-corruption act or for people indicted in the US under drug charges) the picture is very different. In those instances, the targeted persons are not able to move their money into tax havens possibly because the banks and trusts that normally would help them are unwilling to become a target of US prosecutors.

Which goes to show that sanctions only work if you have the means to enforce them and hunt down anyone who tries to avoid them, no matter where they are. A couple of months ago, I wrote how US antibribery enforcement reduces bribery in Africa. This is a similar effect. Nobody dares to mess with the Silverback Gorilla that is US law enforcement. And for that, I applaud US law enforcement. They are improving the world, one indictment at a time.