In 2023, the backlash against ESG investing has gained momentum, particularly in the United States where conservative politicians and lobby groups have put pressure on the SEC and investors to abandon this approach as 'woke capitalism’. A recent survey of investors and executives shows that this approach seems to be backfiring and that is a good thing for the planet.

Bloomberg Intelligence surveyed 250 institutional investors and 250 high level corporate executives about their opinions on ESG and the trends they see emerging in 2024 and beyond. One area where there was complete agreement between executives and investors was that ESG investing is not going away.

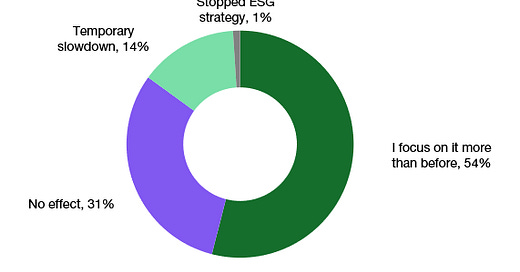

Asked if the US political pushback to ESG investing has led them to change their efforts in ESG investing, more than half of all investors surveyed (54%) said they are now focusing even more on ESG investing than before, while roughly one in three (31%) said they are not going to change their approach in reaction to the backlash. It seems as if that political pushback is not only going nowhere but suffers from the Streisand effect.

Did the recent US pushback on ESG change your investment approach?

Source: Bloomberg Intelligence

When asked about their spending plans for the next two years, not only did both investors and business executives say they will expand their ESG budgets, but 38% of institutional investors and 23% of business executives said their companies will increase their ESG budgets by 20% or more.

What are your plans for ESG spending in the next two years?

Source: Bloomberg Intelligence

This is likely a good thing for the planet because investors paying attention to ESG themes seem to contribute to businesses reducing their greenhouse gas emissions. A group of researchers from the Universities of Leeds and Durham examined what happens when analysts stop covering companies from an ESG angle. To do this, they exploited situations when brokerage companies shut down or merged and hence the number of analysts covering a company was reduced. The results are graphically summarised below. When fewer analysts covered a company, the greenhouse gas emissions started to rise compared to a peer group of companies with similar characteristics.

Effect of reduced analyst coverage on greenhouse gas emissions vs. similar peers

Source: Wang et al. (2023)

They identified four channels that contribute to this effect:

Fewer analysts ask questions about environmental practices in conference calls,

Institutional investors have a harder time getting environmental information from sell-side analysts,

A reduction in business spending on pollution abatement technologies, and

Less stringent corporate oversight related to the environmental goals of the company.

This shows that analysts covering a company from an ESG perspective act as an effective incentive for business leaders to improve their business practices. Hence, as investors increase their ESG budgets and more and more analysts take up ESG criteria as part of their work, we should expect that the pressure on improving ESG practices increases and businesses that ignore these issues will increasingly be penalised in the stock market.

Sorry, but ESG and fiduciary responsibility are diametrically opposed.

Interesting. What can a Private Investor think?

(1) There was (is?) ‘Greenwashing’ with funds attaching ‘ESG’ to the fund name (with holdings largely irrelevant to CC) to attract money - which it did until it did not.

(2) IMO climate change is an existential threat, and international governments should take action to address carbon emissions AND other pollution (ban many uses of plastics) AND spend on mitigation: flood defences etc. In the meantime pious talk does little. Among the other awful consequences of a Trump presidency, will the USA reverse its efforts?

(3) There is a need for Governments to announce measures with public sector involvement AND stick to them: stability & predictability AND SO enable private capital to be invested - correct capital allocation. I see Blackrock has raised $zillions for infrastructure funds, so private capital is there.

(3) Jeremy Grantham (think GMO) suggests the above and has given $zillions of his own money towards it. GMO Asset Management offers a Climate Change Fund, with good holdings, in a GBP class - but I can find no UK ‘platforms’ offering it. The so called ‘climate change’ funds in the UK have holdings which largely are not relevant and unexciting. I appreciate most money is institutional but it would be welcome to have suitable retail funds.