The carbon intensity of asset managers and ESG indices

When it comes to dealing with fossil fuel companies, investors and asset managers can take four different approaches. They can decide to ignore the issue altogether as is typically done in ETFs and index trackers as well as in many conventional equity funds. Alternatively, they can decide to divest from companies that hold fossil fuels or decide to engage with company management to change corporate policy (an approach that we particularly like since it drives change). Finally, in recent years, more and more dedicated climate friendly and “green” funds have been launched that explicitly combine the previous two investment approaches with a preference for investments in renewable energy and other technologies that mitigate CO2 emissions.

In a recent report from InfluenceMap the trends in fossil fuel ownership are examined in fascinating detail. For example, they show how some of the largest asset owners in the world have almost completely divested from coal since the Paris Climate Accord. These range from Sovereign Wealth Funds like the Kuwait and Qatar Investment Authority, which have divested from more than 4m tons of coal reserves from 2016 to 2018, to prominent pension funds like Ontario Teachers or the IBM Retirement Fund. Most notably – because coal companies are so prominent in Australia – the Commonwealth Superannuation Corp. has divested from companies holding a total of 3.6m tons of coal reserves.

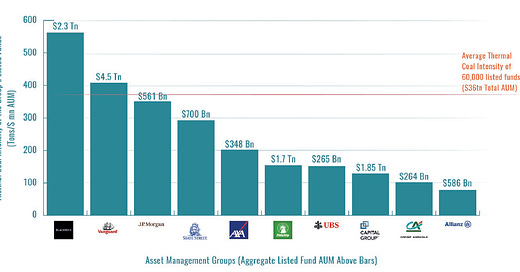

But a reduction or elimination of the exposure to fossil fuels is in direct contradiction to the trend in passive investing. Passive ETFs and index funds are by definition invested in all the companies in an index, no matter what business they are in. As our chart taken from the InfluenceMap report shows, this leads to an extremely high intensity of fossil fuels in the portfolios of these companies' funds. The chart shows the coal reserves held per million US Dollar of assets under management of the largest asset managers in the world. Naturally, in absolute terms, both Vanguard and Blackrock have the biggest exposure to fossil fuel reserves, simply because they are the world’s largest asset managers. But because Vanguard and Blackrock funds are predominantly passive funds, their intensity of fossil fuels per Dollar of assets under management (AUM) is very high as well. Blackrock’s passive funds on average hold 650 tons of coal reserves per million Dollar AUM. In comparison, their active funds average only 300 tons of coal per million Dollars AUM.

The chart also shows that corporate policy does make a difference. Both UBS and AXA have corporate climate change and fossil fuel policies in place and their portfolios have lower coal intensity than their US counterparts. The most aggressive approach has been implemented by Allianz, which introduced a formal coal divestment policy in 2015 and today has a coal intensity that is 80% lower than the industry average. These fund managers clearly have an advantage over passive funds and traditional actively managed funds when it comes to gathering assets from institutional investors in the future.

Index fund providers are trying to react to this trend towards fossil fuel divestment and increased corporate engagement by developing ETFs that track ESG indices. However, these ESG indices are often little more than an effort in greenwashing. The iShares MSCI ACWI Low Carbon Tracker ETF effectively owns 31,000 tons of coal reserves (59 tons/$mn AUM) – about 30 times the coal intensity of the SPDR S&P 500 ETF. Additionally, this ETF owns 207,000 barrels of oil equivalent in oil and gas reserves.

To make matters worse, the SPDR MSCI EM Fossil Fuel Reserves Free ETF and the SPDR MSCI EAFE Fossil Fuel Reserves Free ETF hold 26,800 tons of coal reserves for a coal intensity of 268 tons/$mn AUM – a more than 100 times greater coal intensity than the company’s flagship SPDR S&P 500 ETF – as well as 35,500 barrels of oil equivalent in oil and gas reserves. Not really, what investors would want in a so-called fossil fuel reserves free fund.

This shows that while ETFs and index funds are great for reducing fee costs, they are often not useful for more sophisticated investors or investors who have other priorities than mere fee minimisation.

Coal intensity of different asset managers

Source: InfluenceMap.