One of the most irritating things for investors is that so many strategies to make money may stop working at some point. In particular, anomalies that are described in the literature often stop working after publication and widespread adoption of investment techniques to exploit them. This is one key driver of the miserable returns to factor investing in the last decade.

ESG investing is so new that most anomalies identified in the literature have only been known for a few years and it is too early to tell if they survive the impact of becoming widely known. However, one of the first-ever discovered anomalies in ESG investing is now celebrating its 10th anniversary of publication and Hamid Boustanifar and Young Dae Kang have checked if the described performance still holds up in the decade since publication.

In 2011, Alex Edmans examined the list of “100 best companies to work for in America” and showed that investing in these companies with the highest employee satisfaction created annual outperformance of 3.5% from 1984 to 2009 after correcting for size, value, etc. The basic mechanism is that a company with a highly satisfied workforce experiences lower turnover and fewer sick days. Furthermore, satisfied and motivated employees are more productive. The result is that companies with a highly satisfied workforce have lower costs and higher productivity and thus higher profits.

The problem with employee satisfaction is that it is hard to measure but over the last decade, the rise of Glassdoor and other services have created a way to measure employee satisfaction and the evidence continues to pile on that such measures enable investors to generate outperformance.

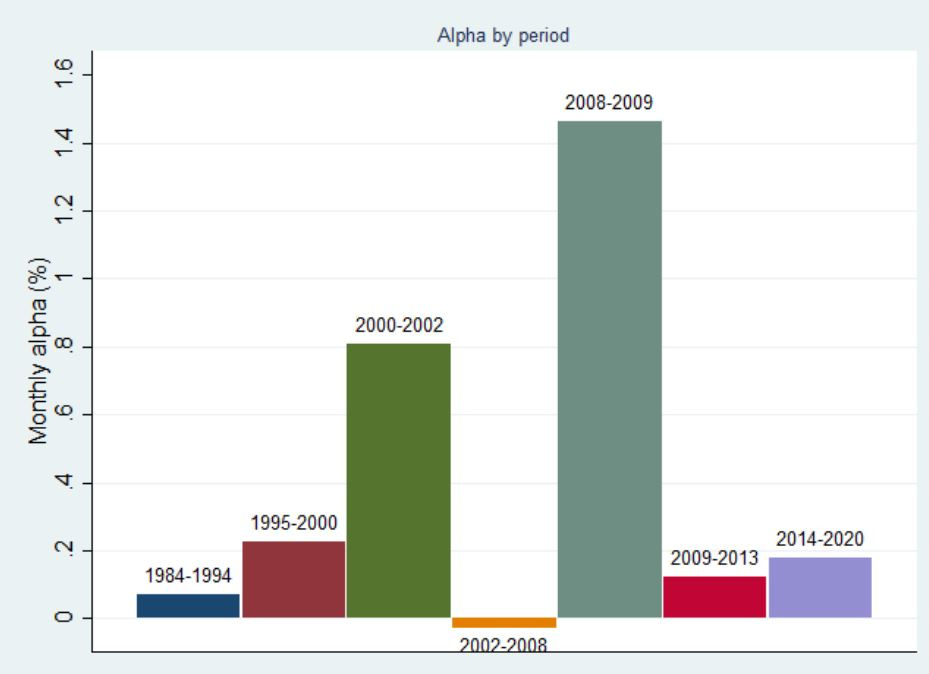

But if measuring employee satisfaction becomes easier to do and more investors use it, shouldn’t that lead to a lower return on that factor? It turns out that this so far is not the case. Employee satisfaction is still a driver of stock market outperformance. Even ten years after the publication of the original study, the outperformance of the best companies to work for remains roughly at the same level as in the original publication. However, by now we have a little bit more insight on the distribution of this outperformance over time and it seems like the outperformance is particularly high in times of crisis. During recessions like 2000 to 2002 and 2008 to 2009, the outperformance of companies with a highly motivated workforce is particularly strong.

Outperformance of 100 best companies to work for

Source: Boustanifar and Kang (2021)

And that makes sense to me. When the economy grows differences in costs or productivity due to a more motivated workforce don’t matter that much. A rising tide lifts all boats. But when the economy shrinks and the company is fighting for share in a declining market and survival, then motivated employees can make all the difference. A motivated employee is less likely to quit and the workforce is more likely to stick together and work as a team to resolve the issues of the company. That’s when employee satisfaction becomes really valuable, but to benefit from that effect, companies must first sow the seeds and create a satisfied and motivated workforce during the good times of an expanding economy. The harvest then comes during the next recession.

"OK everybody we're knocking off early on Friday and I'm putting the company credit card behind the bar at the pub. If anyone from Accounts asks about this, tell them that we're preparing for the next recession."