The Copernican Principle

One of the most common assertions by technology enthusiasts and futurists (arguably one of my favourite targets for ridicule) is that whatever technology is booming today will replace older forms of technology and ruin the companies that produce these technologies. Cryptocurrencies are going to replace fiat currencies and capitalism is coming to an end within a generation. What lucky coincidence it is that it is us who happen to live at the exact time when cryptocurrencies end the reign of fiat currencies as store of value, or when capitalism finally gets replaced by socialism, or some other guiding principle to create well-being! In fact, this line of argument turns us and the times we live in into a very special moment in time - however it is more likely that we live in just some random epoch that seems special to us because we are in it, but in fact is not special at all.

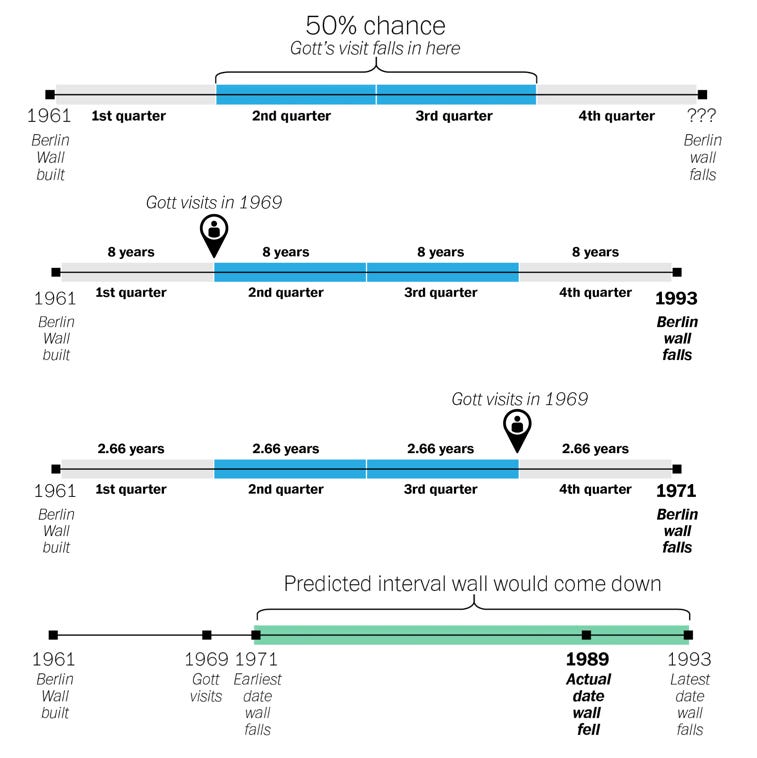

Prof. Richard Gott of Princeton University was to my knowledge the first to analyse this kind of flawed thinking in an article in Nature. During a trip through Europe as a young man in 1969 he stopped at the Berlin Wall and was musing whether he would see the Wall come down during his lifetime. Was the probability of the Berlin Wall coming down higher or lower than the probability of Stonehenge being destroyed during his lifetime? Because he did not think that him visiting the Berlin Wall happened at any special time, he thought it is very unlikely that he would be visiting the Wall the day before it came down. Similarly, it was highly unlikely that the Wall would stand many hundreds of years in the future because that meant he would visit the Wall very close to the beginning of its lifetime. He thought, if he visited the Wall at some random point in time there would be a 75% chance that he would be visiting the Wall after a quarter of its total lifetime had passed, and a 75% chance he would be visiting the wall after three quarters of its lifetime had passed. At the time of his visit, the Wall was eight years old, so he calculated that there is a 50% probability the Wall would come down sometime between 1971 and 1993 (see chart below). Stonehenge, on the other hand, had been around for roughly 4,000 years, so he calculated that, with a 50% probability, Stonehenge would survive another 1,300 to 12,000 years from the day of his visit.

Of course, history proved Gott right, but it also allowed him to develop a general theory that allows one to estimate the likelihood of future survival only by knowing how long something had been around. For example, the longer a show has been performed at the West End, the more likely it is that it will be performed for a long time into the future. Shows that have only recently started, on the other hand, have a high likelihood of being cancelled in the next few months. This is simply a reflection of the fact that very few shows are incredibly successful (e.g. The Lion King or Cats) while most shows are not popular enough to survive for many years.

The same is true for economic phenomena like stores of value or different technologies. Certain exceptions notwithstanding, most technologies are replaced or “die” very quickly. Do you remember the steam cars or electric cars of the early part of the twentieth century? Cars powered by internal combustion engines were more efficient and thus drove early electric and steam cars into extinction – and the companies that built them with it. Similarly, hardly anyone today remembers MySpace, an early form of social networking, while everyone today thinks that Facebook will be with us forever.

The approach of Richard Gott allows us to estimate the likely time a given company or technology will survive in the future. If our current moment in time is not in any way special (it could be, but it is unlikely) then Gott’s so-called “Copernican Principle” allows us to calculate a confidence band for the future survival. I stress that this estimate is based on complete ignorance about the driving forces behind a phenomenon and, as a result, the confidence intervals are very wide, but it nevertheless, provides a good first guess, because unlike the work of so many futurists, it is grounded in sound logic and maths. Let’s see how this works in practice.

When it comes to stores of value, gold has been used as a store of value for at least 5,000 years, while fiat currencies have been around only since the end of the gold standard in the 1930s, i.e. about 90 years. Cryptocurrencies like Bitcoin, on the other hand have been around for only about ten years. I won’t bore you with the exact maths, but the Copernican Principle predicts that:

Gold will remain a store of value sometime for at least another 128 years and up to 195,000 years (95% confidence interval).

Fiat currencies will remain a store of value for at least the next two years and up to the next 3,510 years (95% confidence interval).

Cryptocurrencies like Bitcoin will stop being accepted as a store of value sometime between the next three months and 390 years from today (95% confidence interval).

In other words, it is highly unlikely that Bitcoin and other cryptocurrencies will outlast fiat currencies and gold will likely still be accepted as a store of value long after fiat currencies have gone out of fashion. This does not mean that Bitcoin or cryptocurrencies in general will not replace gold and fiat currencies, but it is highly unlikely that they will and I, for one, would not bet my money on it.

Similarly, we can look at the expected lifespan of technology companies.

Facebook has been around for 15 years now and with a 95% probability will be around for at least another six months and up to another 585 years.

Microsoft has been around for 40 years and with a 95% probability will still exist in one year and up to another 1,560 years.

IBM has been around for more than 100 years and with a 95% probability will still exist in two years and up to 3,900 years.

Note that this likelihood says nothing about the profitability of either company, it just states that because IBM has survived so many more technological changes than Microsoft, and Microsoft in turn has adapted to many more technological changes than Facebook, it is more likely that Microsoft will survive a technological change that can bring down Facebook And IBM will survive changes that could bring down Microsoft.

How Gott estimated the remaining lifetime of the Berlin Wall in 1969

Source: Desispeaks.com