…is essentially zero. That is what a study by Gilbert Metcalfe and James Stock found for countries that have introduced a carbon tax as high as $130/tCO2e.

Finland was the first country in the world to establish a carbon tax in 1990, followed closely by Sweden and Norway the year after. Today, Sweden has the highest carbon tax in the world at $128.91/tCO2e in 2018 US Dollars. The Swedish carbon tax covers some 40% of the greenhouse gas emissions of the country and generates around $2.6bn in revenue for the Swedish government.

And concerns of industry and anti-climate lobbyists are that this kind of carbon tax will reduce economic growth and cost people’s jobs. At best, they argue, businesses will simply move their factories abroad to countries where they can avoid the carbon tax and then re-import the manufactured goods. This potential regulatory arbitrage is also why the EU is working on plans to introduce a carbon border adjustment tax to prevent that from happening.

Except if you read the study of Metcalfe and Stock, it seems we don’t have to worry about regulatory arbitrage, nor do we have to worry about job losses or weaker economic growth because of this cost factor.

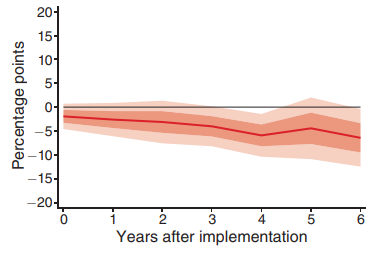

Looking at all existing carbon tax schemes in the world (15 countries including the UK covering on average 30% of greenhouse gas emissions), the chart below shows the estimated level of GDP in the years after the introduction of a carbon tax. If you think that looks like the effect is zero or if at all it increases the level of GDP by 1% you are right. There is no indication that the level of GDP is different with the carbon tax than without the carbon tax. And that even goes if one restricts the sample to the countries with the highest carbon taxes in the world.

Impact of a $30 carbon tax on the level of GDP

Source: Metcalfe and Stock (2023)

But maybe employment will suffer, particularly in the manufacturing sector where processes can be outsourced to cheaper countries without a carbon tax. Again, no. Our second chart below shows that there is zero impact on the level of employment from a carbon tax and the same goes for manufacturing employment. There simply seems to be no systematic evidence that carbon taxes hurt the economy except for a few selected anecdotes.

Impact of a $30 carbon tax on the level of employment

Source: Metcalfe and Stock (2023)

But what about the ultimate goal of a carbon tax, namely, to provide an incentive to reduce emissions? There, the third chart of today shows that there is a modest reduction of some 6% in carbon emissions in the years after the introduction of a carbon tax. However, that looks to me like not a lot, particularly given that the industries covered by carbon taxes like the power sector typically are easy to abate. If one really wants to create an impact on carbon emissions, one would likely need to expand the carbon tax to close to 100% of the emissions of a country, which most importantly would mean a carbon tax on homes and cars. Then, the authors of the study argue a carbon tax could have a meaningful impact.

Impact of a $30 carbon tax on emissions

Source: Metcalfe and Stock (2023)

But if you ask me, such an expansion of carbon taxes to include cars and homes is pretty unlikely outside of Western Europe. There simply isn’t the political will to do that. And as long as the political will is lacking, I think carbon taxes will be nothing more than a bucket of water on a house on fire.

Individual European country carbon taxes tend not to cover the power sector, hence the marginal cost of abatement is much higher and the prospect of us seeing significant emission reductions is much lower. With the exception of Sweden and a couple of other countries the carbon taxes are very low and cover a small part of the overall economy. The advantage of cap-and-trade schemes such as the EU ETS over carbon taxes is that they specify an emission reduction and let the market work out what price is necessary to achieve that reduction. Carbon taxes are always likely to be too low to make a difference. It will be interesting to see the impact of EU ETS II (covering domestic heating and transportation) when it is introduced in 2027/28.

This is why normal people don't trust experts. Everyone can look around and see the price of diesel, gas, and furnace oil go up and take up an ever expanding chunk of our paycheck. Everyone can see that the stuff we buy gets delivered on by trucks and cars and boats and planes, all of which use gas, diesel, jet fuel etc. Then silly things like this come from the uppers and we're supposed to nod along. As the saying goes, "who should I believe, you or my lying eyes?"