In the past, the focus of professional ESG investors was on getting better disclosure and increased transparency of a business’ environmental and social practices. As transparency improved, the focus increasingly shifted to concerns about greenwashing activities. Today, a company that engages in misleading communication about its environmental or social practices will be punished by investors. But how significant is the effect of this punishment in practice?

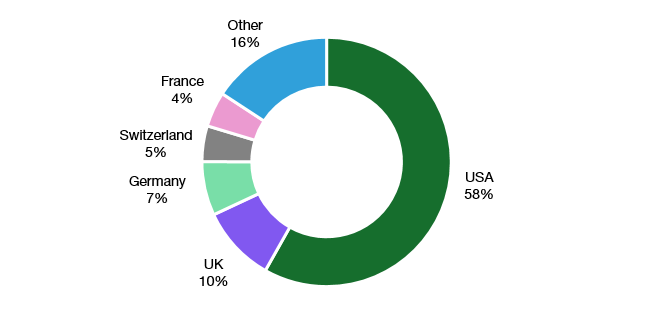

To find out, the authors of a new study examined more than 5,000 cases of greenwashing uncovered by RepRisk between 2007 and 2022. The study focused solely on the 12 largest developed stock markets to ensure that these markets were sufficiently transparent, with high standards of corporate governance and a large share of institutional investors. The chart below shows that more than half of all incidents of greenwashing were attributed to US companies. UK companies are the second most common culprits.

Share of greenwashing incidents by country of business

Source: Akyildirim et al. (2024)

Interestingly, greenwashing wasn’t penalised similarly harshly in different countries. In the US, the UK and Canada, share prices dropped more in response to greenwashing incidents than in Japan and Australia. Continental European countries showed a mixed picture without clear trends.

But if we aggregate all the incidents into one chart, we are left with the picture below. A novel greenwashing incident (i.e., one reported by RepRisk for the first time) on average results in a 2.5% drop in share price in the days immediately following the RepRisk alert. This underperformance persists for about two to three months before reverting partially. But even six months after the alert, a company hit by a greenwashing alert sees its share price some 0.6% below a similar company that has not had a greenwashing incident.

Over time, as more greenwashing incidents occur, the effect becomes smaller, as indicated by the purple bars, which represent low novelty greenwashing incidents. Effectively, investors seem to lose trust in a company that has credibly been accused of greenwashing. Once a greenwasher, always a greenwasher appears to be the motto of investors.

Share price reaction to RepRisk greenwashing alerts

Source: Akyildirim et al. (2024)

Greenwashing or whatever, lying comes at a cost.