Being an investment strategist for much of my career, I always felt like the demand for my services has a negative correlation with market performance. In a bull market, investors don’t seem to care too much about the big picture, but let there be a recession or a crisis and macroeconomics and geopolitics is all they are interested in.

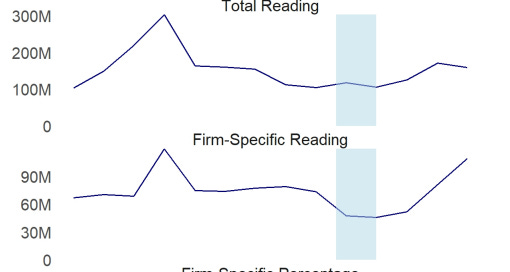

A team of researchers has examined this hypothesis during the Covid pandemic of 2020 and found that my personal experience wasn’t too far off. Using a large database of news articles and data of readers who accessed these stories, the researchers identified and tracked the reading habits of institutional investors at more than 3,000 firms over time. The chart below shows the total number of articles read (i.e. each individual reading an article is counted as one unit, so an article read by 1,000 people is counted as 1,000 units) together with the number of articles read that were specific to a firm rather than generalist in nature.

Firm-specific reading habits of institutional investors

Source: Kwan et al. (2022)

It is clearly visible how the focus shifted away from firm specific news during the initial phase of the pandemic and only recovered once it became clear that markets recovered. A more detailed statistical analysis revealed that better macroeconomic data leads to a lower focus on economics news and an increased focus on firm-specific articles and news.

If one digs deeper, one can see that investors focus mostly on companies they already hold in their portfolios rather than companies they don’t hold. If a fund increases its reading of stocks they don’t hold, it often indicates a future purchase of the stock, so reading habits predict future fund flows. However, these fund flows have little effect on future stock returns. This is important to realise since many people like to read the regular updates on fund manager positioning in order to get an idea how fund flows will move in the future. The problem with this is that fund flows do not have a significant influence on future share prices. There is a significant number of articles that claim so, but this paper, which unfortunately is rather technical, has put serious doubt on all these results because the methodology used in them is probably flawed and creates spurious correlation between flows and price reaction.

Agree this has been my experience as well.

On a bright sunny day , it hardly matters who is flying the airplane, just as long as I get from A to B without much trouble.

In stormy weather, an experienced pilot is a necessity. Their expertise and knowledge increase the possibility of a safe and smooth journey through turbulence and bad visibility.

Trustworthy and skilled, they are the better option when conditions are harsh.