I bet you anything, the members of the Fed Open Market Committee would rather have killed off zombie firms with the latest rate hikes than prolonged their life (death? undeath? What do zombies do?). Yet, according to an analysis by the IMF’s Bruno Albuquerque and Chenyu Mao higher interest rates may hurt healthy firms more than zombie firms.

First, we need to clarify what zombie firms are in this context. Many people have many different definitions of zombie firms, but in this study, zombie firms are companies that for at least two years in a row meet all three of the following criteria:

They cannot cover their interest rate payments from operational cash flow,

They have excessive leverage (i.e. leverage ratios are above the industry median), and

They experience negative real sales growth (i.e. they lose market share).

The chart below shows the share of all companies worldwide that meet that definition.

Share of zombie firms worldwide

Source: Albuquerque and Mao (2023)

Normally, one would expect that higher interest rates hit these overlevered companies harder than healthy firms so more of them should go bankrupt, but it seems that it is their leverage that gives them an advantage in times of rising interest rates.

Think about the saying that if you owe the bank a million dollars, you are in trouble, but if you owe the bank a billion dollars, the bank is in trouble. Zombie companies tend to be the customers that owe banks a billion dollars rather than a million. When interest rates rise, they will go to their lenders and tell them that they can’t pay their loans anymore. What is a bank to do in such a situation? It can decide to call in the loan and let the zombie firm default on the loan in which case the loan will end up as nonperforming and a loss for the bank. Or, it can decide to refinance the loan for the zombie firm and maybe even provide an even bigger loan facility to make sure the firm can survive and the existing loans don’t go bad.

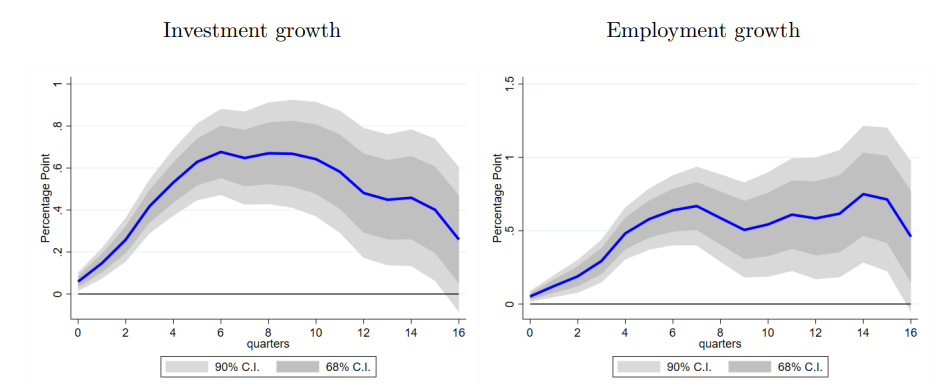

Ironically, what banks seem to do is throw good money after bad in order to prevent bad loans from piling up on their balance sheet. They tend to roll over loans to zombie firms to a higher degree than loans to healthy firms. The result is not only that zombie firms face less of a credit crunch than healthy firms, but that investment activity and employment in zombie firms decline less than for healthy firms. In effect, capital and jobs tend to shift from healthy companies to zombie companies.

It’s not what the rate setters would want to see, but as the charts below show, it is what seems to happen on average.

Relative change in debt levels and interest burden between zombie and healthy firms

Source: Albuquerque and Mao (2023). Note, that positive values indicate a relative shift of capital toward zombie firms and away from healthy firms.

Relative change in investments and employment between zombie and healthy firms

Source: Albuquerque and Mao (2023). Note, that positive values indicate a relative shift of capital toward zombie firms and away from healthy firms.

Do you think the bank would act similarly (I believe some already are) for commercial real estate companies when their loan payments would come due, as this sub-sector is currently struggling with all the remote work, especially in big cities?

Do they name some of these zombie companies ? Is it a mix of publicly traded & private? It seems extraordinary...