The inflation trust game

Later today, the US Bureau of Labor Statistics will publish its June inflation data. Thanks to declining energy prices, economists expect the annual inflation rate to decline to 1.6% while core inflation should remain stable at 2.0% year-on-year. In the Eurozone, meanwhile, the final inflation numbers for June will also be published. There, inflation hovers barely above 1% despite negative deposit rates at the ECB and a mandate for the ECB to target 2% inflation in the medium term.

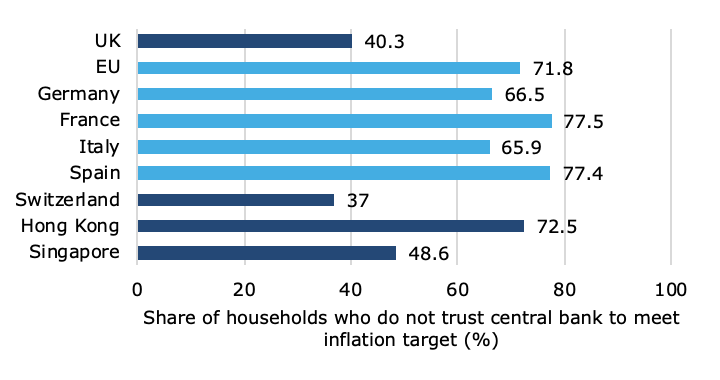

It has been years since inflation was above the 2% target adopted by most central banks in the West. No wonder then that a large majority of private households does not trust their central banks to meet their inflation targets in the next three to five years. The chart below shows the results of a range of household surveys between 2013 and 2015, a time when inflation rates were very low, but only for a couple of years or so. Today, we are facing a situation where inflation rates have been (too) low for more than a decade, so my guess is that the numbers are worse today.

This poses a major challenge for central banks and investors alike. When the public loses trust in the central bank two things happen. First, monetary policy increasingly becomes a political punching bag. After refusing several times to cut interest rates, the governor of the Turkish Central Bank, Murat Cetinkaya, was fired by President Erdogan on 6 July 2019. No reasons were given, but it seems clear that Erdogan did not want to put up with an independent central banker who refused to stimulate the economy and risk runaway inflation. Donald Trump, the wanna-be strongman in the White House has publicly pushed Fed Chair Jerome Powell several times to cut interest rates. He also has publicly pondered the idea to fire Powell if he does not comply. If he followed through on this threat, the credibility of the Fed as an independent central bank would suffer severely.

The second thing that tends to happen when trust in the central bank erodes is even more insidious. The public starts to second-guess the central bank’s policy actions and mentally adds an inflationary or deflationary bias to the official target rate of inflation. According to a study by the Bank for International Settlement those households that lose trust in central banks on average either add an inflationary bias of one percentage point or a deflationary bias of -0.67 percentage points to the official inflation target. Interestingly, while most countries show signs of having households with an inflationary and others with a deflationary bias, some countries like Spain seem to have only a deflationary bias, while households in Italy seem to have only an inflationary bias.

That trust and inflationary biases differ even within the Eurozone is remarkable and points to a different perception of the work of the ECB across the Eurozone. And that should really worry investors. After all, we live in a world of forward guidance and unconventional monetary policies. The main weapon for central banks these days isn’t the policy rate anymore, it is the ability of the central bank to shape expectations about the future. If central banks lose the trust of the markets, forward guidance and unconventional monetary policy measures quickly become ineffective. And then we are stranded in a zero interest rate world without any effective tools left on the monetary policy front.

Share of households that do not trust the central bank to meet its inflation target

Source: Lamla et al. (2019).