The information tortoise vs. the breaking news hare

We live in an age where breaking news dominates the financial media. Information about major company X missing its revenue or profit targets immediately leads to a reaction in the share price. But not all news travels so fast. Some news is only incorporated slowly into the share price. And that provides opportunities for investors.

If news about a company is incorporated immediately, investors have no chance of jumping in on a stock to benefit from it. Markets are efficient in incorporating that news and actively trading these stocks is a losing game.

But sometimes, a company may issue positive news, but the share price doesn’t rise. Instead, it drops or moves hardly at all. These are cases when positive news is temporarily ignored or overlooked by Mr Market and only slowly incorporated into the share price over the course of days or sometimes weeks. In my experience, this happens particularly often in a bear market when a company has positive news. Because the mood is so negative, this kind of positive surprise in a negative sentiment environment tends to be integrated into the share price much slower than negative news in a negative sentiment environment.

Be that as it may, a team of researchers from the University of Reading in the UK have investigated if it is possible to beat the market by focusing on news that is slowly incorporated into the share price and ignoring news that is incorporated quickly. By looking at US stocks and the price reaction to news about a company, they differentiated between slowly incorporated news (positive news accompanied by negative share price reaction or negative news with positive share price reaction) and quickly integrated news (positive news accompanied by rising share prices, etc.).

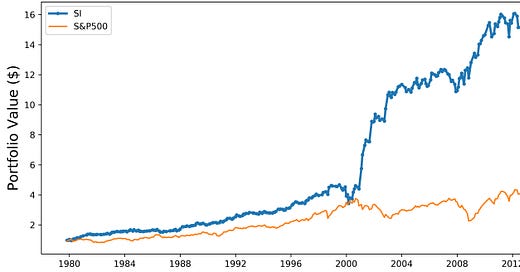

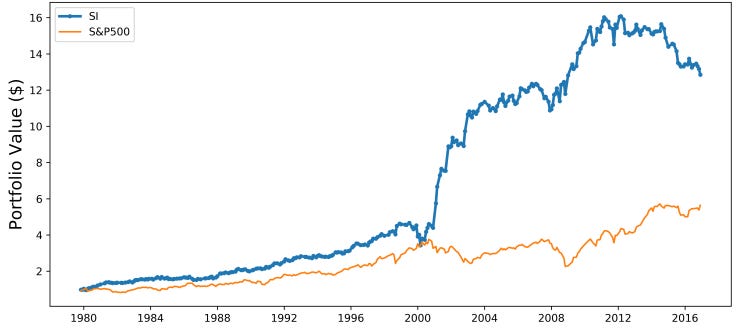

An investment strategy investing in shares that incorporate news slowly manages to outperform the S&P 500 by more than 1% per month. Even if trading costs as high as 58bps per month are included and smaller stocks with high bid-ask spreads and low liquidity are included, this strategy still outperforms the S&P 500.

Performance of stocks slowly incorporating news with 25bps trading costs

Source: Tao et al. (2021)

This is most likely due to the limited attention effect. Stocks in the spotlight of investors tend to incorporate news quickly and efficiently. But other stocks do so much more slowly. Which stocks tend to incorporate news more slowly? Smaller stocks, less liquid stocks, stocks followed by fewer analysts and stocks less covered by the media are the ones that fall under this category. And looking for investments where few others are looking can be a significant advantage as this study shows.