The large cap bias in ESG investing

A couple of months ago, the European Commission published a really good study on the current state of play in ESG data, ratings, and research. It is essentially a 214-page expose of what is wrong with ESG data providers and the mess they created that keeps investors and companies confused and results in slower adoption of ESG.

If you aren’t a specialist in ESG you might be particularly interested to learn how data providers collect their data, which is explained in some detail in the study (as well as many other pitfalls that non-ESG specialists typically fall into). It’s scary and shows why it still is so easy for greenwashers to get away with it.

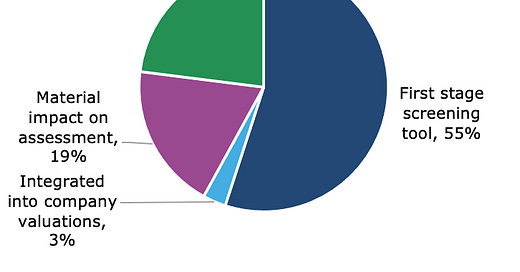

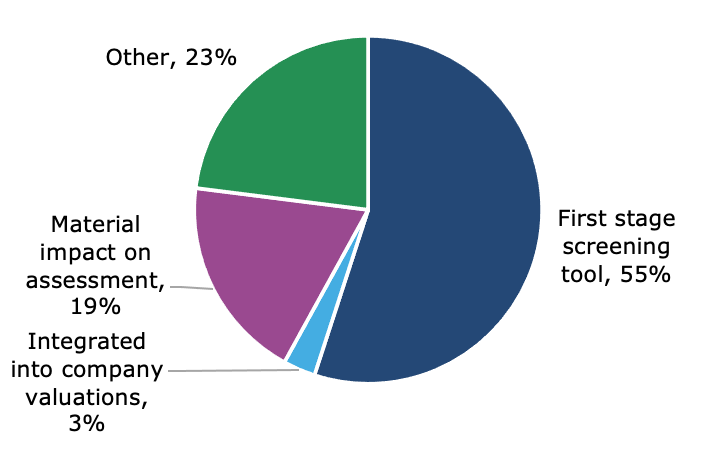

But one thing that surprised me was to see how ESG investors inadvertently create a large cap bias in their portfolios. First, look at the chart below which are the responses from 31 large asset management firms on how they use ESG ratings.

How asset managers use ESG ratings

Source: EU and ERM (2020).

Given that ESG ratings aren’t really reliable indicators of future performance it is no surprise that the rating itself isn’t typically used to influence company valuation models or has a material influence on the assessment of a company. Instead, ESG ratings are typically used as filters to separate the good from the bad so that asset managers can focus on the companies with decent ESG credentials for further analysis. This makes sense because no asset manager can perform an in-depth analysis of all companies they potentially could invest in.

But by relying on ESG ratings as a first stage filter, asset managers are implicitly creating a significant large cap bias in their portfolios. This happens because of two factors. First, smaller companies often aren’t rated by the big rating agencies like Sustainalytics or MSCI ESG. These rating agencies rely on demand from their investor clients to decide which companies to rate. And since there is typically higher demand for large cap companies to be covered, the rating agencies have to cut off their coverage somewhere around a market cap of $300m to $500m. And that means that many smaller companies don’t even appear on the radar screen of ESG investors.

The second effect is that larger companies have more resources to disclose ESG information in their annual reports and on their websites and have more money to pay to outside consultants to develop ESG strategies and measure the impact of a business on the environment and society. Smaller companies often lack the time and money to present their ESG credentials in the best possible light. And that means, that if you look at the ESG ratings of companies there is a significant large cap bias amongst the companies with the best ESG ratings.

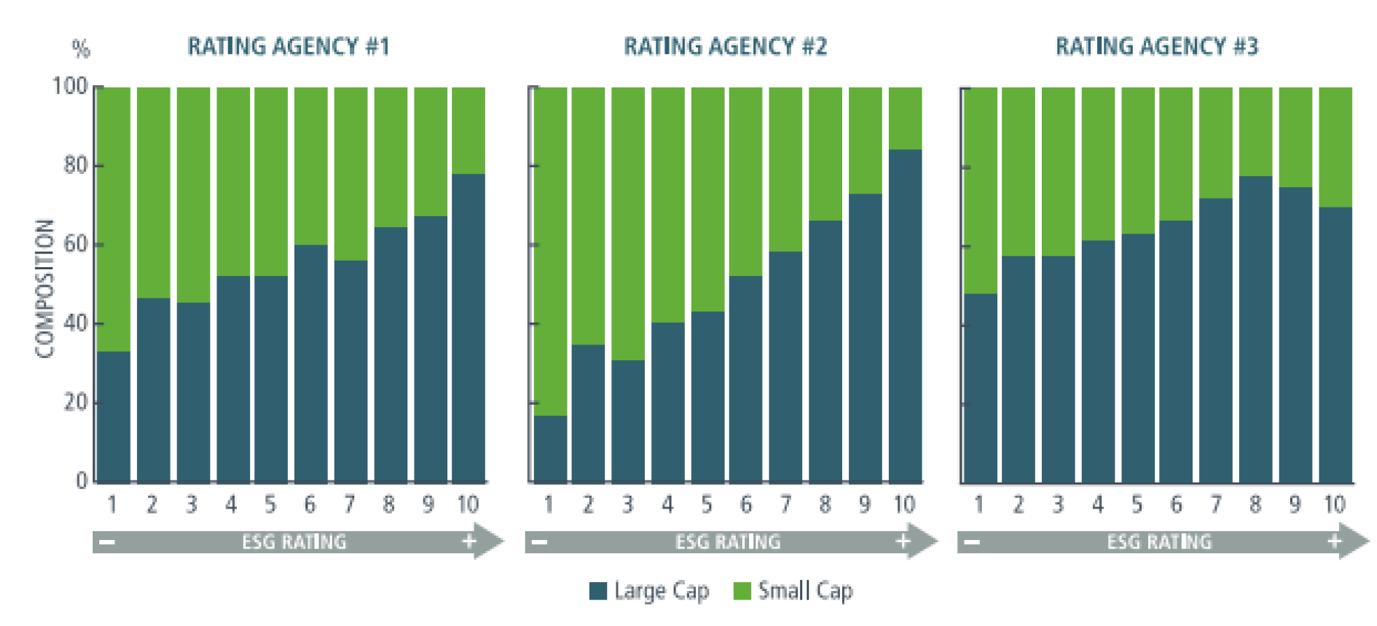

Large cap bias for companies with better ESG ratings

Source: LaBella et al. (2019).

Investors who use ESG ratings as a first stage filter thus end up ignoring a lot of smaller companies and a significant large cap bias in their portfolios.

In my experience as an investor, this is not a good way to invest sustainably, because many smaller companies are in fact more sustainable in their business practices than larger companies. Often, they are managed in a more long-term oriented way (especially if they are family-owned) but they don’t shout that from the rooftops. It just comes naturally to these companies.

Investors who are willing to go the extra mile and focus more on smaller companies will quickly find companies that have no ESG rating but are doing a much better job at managing ESG risks than their larger peers. And that is a significant opportunity for investors because as ESG investing becomes more popular, more and more of these smaller companies will be covered by ESG rating agencies and specialist ESG investors. Today, they may still be under-researched, but as they become better known, their stocks will attract more investors and their valuations are likely to rise.