The long-term outlook for CO2 as an investment

Last Monday, I was mentioning that CO2 prices are currently way below where they should reasonably be in order to put us on a path to meet the Paris climate goals. At current prices for CO2 emissions certificates somewhere between $20 and $40 per tonne of CO2, the incentive is for polluters to keep emitting greenhouse gases. Of course, the low prices for CO2 are a result of political considerations because it would be highly unpopular in most countries to raise prices to the levels around $50 needed today.

This is why I like the approach of the EU. They have long decided to take the supply of certificates out of the hands of politicians and lock it into a mechanical formula to achieve the 2050 climate goals. Beginning this year, the annual reduction in CO2 certificates across the EU has stepped up once more and the number of certificates is reduced every year by 2.2% (previously 1.7%). Additionally, 12% of certificates are held back and sold at a minimum price each year. This way, the EU hopes to reduce its CO2 emissions by 43% in 2030 relative to 2005.

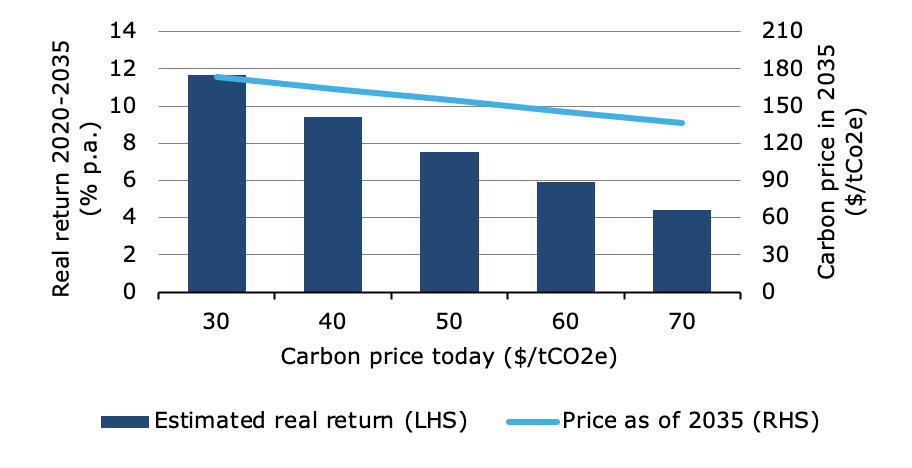

This kind of mechanical reduction in supply ensures that prices for CO2 rise over time but probably, prices have to increase more than that. Christian Gollier from the University of Toulouse has done an interesting calculation. He has started with current CO2 prices and used the current Integrated Assessment Models (IAM) to calculate where CO2 prices should be in 2035 to ensure that we achieve the Paris climate goals. These prices then allow him to calculate the annual real return of investing in CO2 emissions certificates. Obviously, the lower CO2 prices are today, the more CO2 is emitted today and the higher prices have to rise in the 2030s to reduce emissions then and to stay within the total CO2 budget for the planet.

If CO2 prices are somewhere around $30 per tonne as they are in most auctions in Europe, then prices have to increase to c$173 per tonne in 2035 for an estimated real return after inflation of 11.7% per year. That is way more than equities or almost all investments you can find today. Even if prices for CO2 would double today to $60 per tonne, the expected real return over the next 15 years would be 5.9% per year and somewhere close to what equities have achieved in the long run in most countries.

Expected real returns for CO2 if we want to achieve the Paris climate goals

Source: Gollier (2020)

So, if we want to achieve our climate goals, CO2 is likely going to be one of the best investments you can make today. But the emphasis is on the word “if”. Politicians are notorious for changing the rules of the game if it is convenient. So, I wouldn’t bet on us actually achieving the Paris climate goals to begin with if it becomes too costly. But even if I half the price of CO2 in 2035 from the projections above, the real returns are still very high, making CO2 a really attractive investment for the coming decade. No wonder more and more hedge funds are investing in these certificates to make an extra profit.