The overlooked opportunity in CLO

Whenever I start talking about CLO, Collateralised Loan Obligations, I get one of two reactions. Either people’s eyes glaze over because they don’t understand these structured finance investments, or people start to gasp as they are reminded of the disaster that were CDO (Collateralised Debt Obligations) during the financial crisis.

Back in 2008, these CDO were based on piles of mortgages, many of which were sub-prime and defaulted during the crisis. The results was a market crash of epic proportions that famously brought down Lehman Brothers and almost bankrupted other global banks, such as UBS or Citi. For more than a decade now, these instruments have been shunned by investors, even though CLOs that have been created after the financial crisis have had more safety features than the ones created before and CLOs are not just based on mortgages but all kinds of loans.

This is not the place to go into the details of how CLOs work, but readers who are interested to learn about CLOs can find a primer I wrote in early 2019 here.

Instead, what I want to focus on here is how investors have been afraid to touch these instruments and thus created a significant investment opportunity. To be sure, central bankers and market pundits have been warning of CLOs and senior loans as the epicentre of the next financial crisis since 2020. During the pandemic last year, some people thought the day had come when CLO investors would finally have to pay the bill for their greed. Yet, it turns out that the pandemic turned, in my view, into a proof of concept that showed that the new type of CLOs created after the financial crisis are far safer.

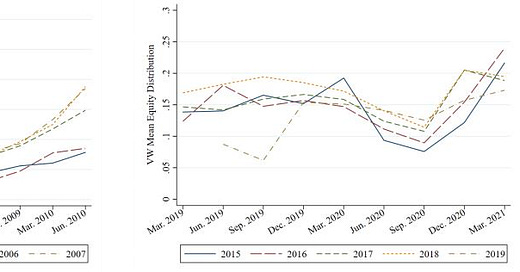

An analysis by researchers from the Federal Reserve Bank of Philadelphia and the University of Philadelphia looked at the performance of US CLOs during the pandemic and compared it with the financial crisis. The chart below shows the returns of the riskiest “equity” tranches to investors. Throughout the last two years, the distribution to equity tranche investors has never dropped below 10% per year, even at the height of the pandemic.

Return to equity tranche investors in US CLOs during the financial crisis (left) and the pandemic (right) by vintage

Source: Cordell et al. (2021)

Further analysis shows that on average, investors in CLO equity tranches earn an average annual premium over the S&P 500 of 0.4% after fees. This, in my view is a reflection of the complexity of the product, the relative lack of liquidity and the aversion of many investors to invest in these instruments to begin with. And to be sure, this is not a recommendation to throw all caution in the wind and go and buy these things. Investors need to understand what CLOs, how they work and the details of individual closed-end funds listed for example on the London Stock Exchange. But once investors have done their due diligence, CLOs provide an overlooked opportunity, in my view.