The power of narratives in the US stock market

About a month ago, I wrote about a Chinese study that showed that stocks associated with narratives rising in popularity outperform stocks associated with narratives of declining importance. Back then I said that these results needed to be taken with a grain of salt because the Chinese stock market is different from developed markets. Little did I know back then that just a couple of months earlier, two researchers from the University of Missouri tested a similar effect in the United States.

Dat Mai and Kuntara Pukthuanthong examined more than 2 million articles in the Wall Street Journal and the New York Times going back to 1871(!) and analysed the prevalence of certain keywords in the articles of these newspapers.

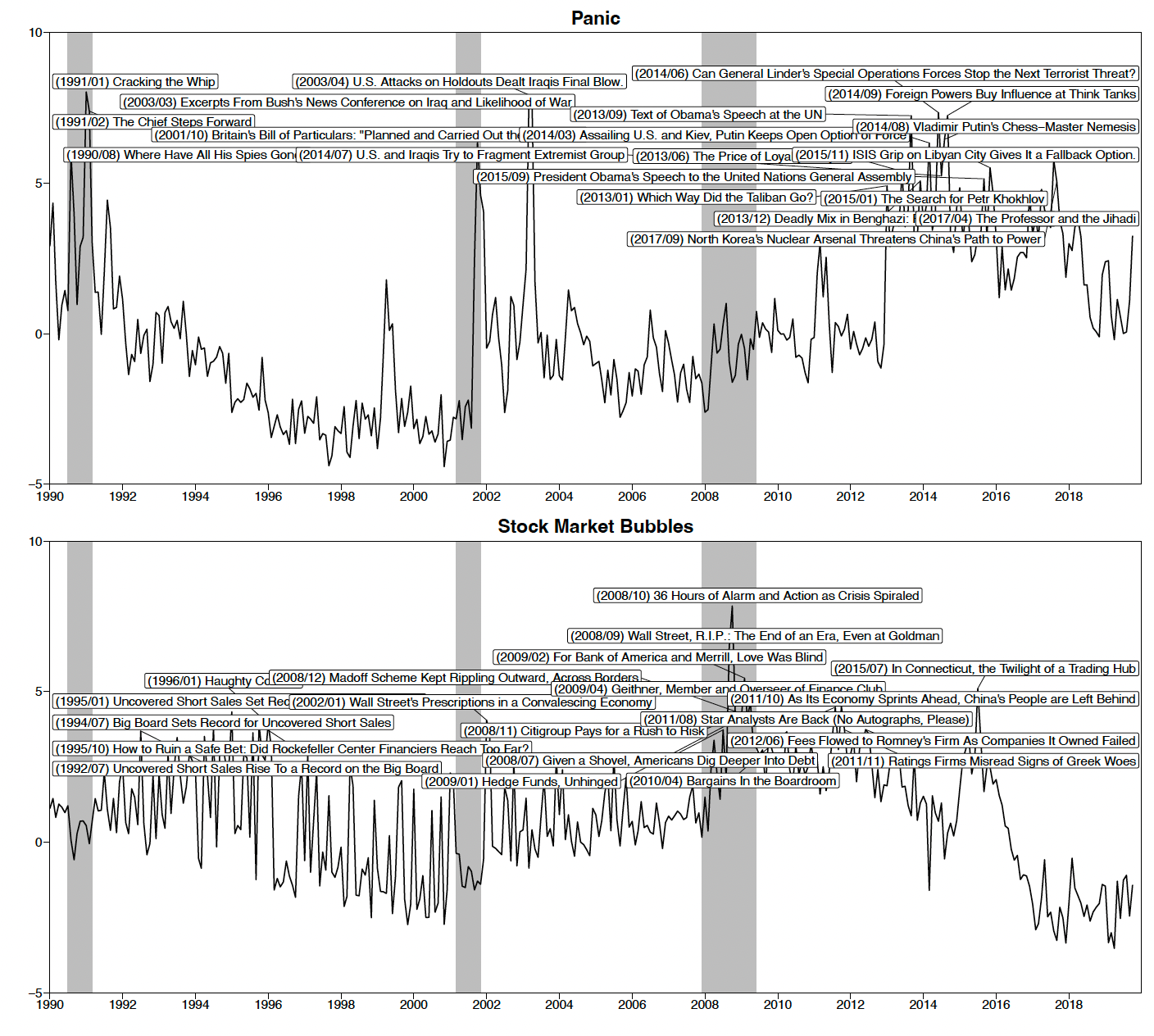

Based on their analysis they could find two key narratives that influenced the overall direction of the stock market: “panic” and “stock market bubble”.

When the number of articles associated with panic and similar words spiked, the US stocks market returns in the subsequent 12 months were on average 5.5% higher than normal. If the number of articles associated with stock market bubble spiked, the subsequent 12 months saw stock market returns drop by 4.6% on average. These return differences declined somewhat when economic variables and disasters were taken into account but remained highly significant both in statistical and economic turns.

In other words, when everybody is panicking it is a good time to buy stocks. But when everybody is worried about a stock market bubble, chances are they are on to something. That does not mean that the market will crash, but it means it will underperform. So don’t trust market pundits who predict the market to crash because it is in a bubble, but instead look at the general mood in the market and if many people agree it is a bubbly market, then expect a period of sideways or slightly down markets.

To show what I mean, I have copied the panic and stock market bubble counts since 1990 and the articles that were most prominent at the time. Note how the count for stock market bubble spiked in 2011 and 2015. Back then we didn’t have a stock market crash, only a period of 6 to 12 months of sideways markets.

Mentions of panic and stock market bubble in US media

Source: Mai and Pukthuanthong (2021)