The real-life costs of central banks missing their inflation targets

I often write about how inflation expectations matter much less (if at all) for future inflation and central bank policy. However, there is one area where inflation expectations matter a lot and where central banks missing their inflation targets can have a significant economic impact: government deficits.

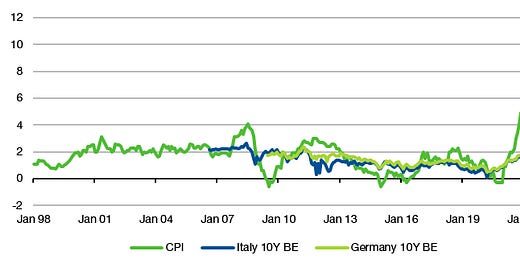

Look at the chart below, which shows the inflation in the Eurozone together with the 10-year expected inflation priced in bond markets. One thing you note is that for most of the 2010s, inflation undershot expected inflation.

Eurozone inflation and expected inflation priced in bond markets

Source: Liberum, Bloomberg

This difference in expected inflation and realised inflation does have real-life consequences for governments. If a government issues new debt, it must pay interest that implicitly covers the expected inflation rate for the duration of the bond. If inflation undershoots this expected inflation rate, the interest costs for the government are higher than if the central bank had managed to meet its inflation target. If the inflation rate overshoots, the government was able to borrow funds at a lower cost of debt than if the central banks had managed to meet its inflation target.

The more the central bank undershoots its inflation target (or to be more precise, the expected inflation rate priced in the market), the more the government overpays for its debt. The longer the maturity of the bonds issued by the government, the more it overpays as well.

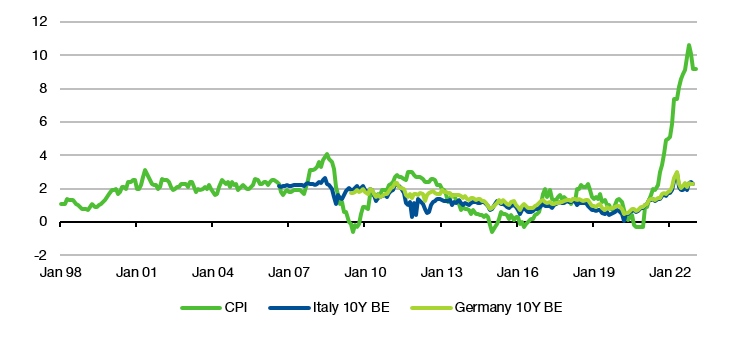

Michele Andreolli and Hélène Rey from the London Business School calculated the average duration of government debt in different countries to estimate how much it costs a government when the central bank does not meet its inflation target. The chart below shows the change in average duration over time of different European countries and the US. Note the much larger duration of UK Gilts compared to US Treasuries or Eurozone countries. In early 2022 the duration of UK Gilts was 12.3 compared to 8.0 for the US and 4.4 for Germany. Italy boasts the highest duration in the Eurozone at 9.3, still well below the duration of Gilts.

Duration of government bonds

Source: Andreolli and Rey (2022)

This means that if the Bank of England undershoots its 2% inflation target, the effective costs for the UK government will be much higher than if the ECB undershoots its 2% inflation target. On the other hand, if the Bank of England overshoots its inflation target as it has done in 2021 and 2022, the UK government has a much bigger windfall than other governments as the saving in debt payments accumulates faster.

Because central banks have systematically undershot inflation expectations since 2001, the researchers estimate that the US government has paid some 2.2% of GDP too much in interest to bondholders. The German government paid about 1.1% of its GDP too much in interest over the same period. We don’t have estimates for the cost to the UK government but given that the duration of Gilts is roughly twice that of the US and three times that of Germany, one can guess that the cost to the UK government was some 3-4% of GDP. The beneficiaries of these developments were bondholders who effectively got paid too much in interest for their assets.

And if there is one good thing about the current bout of inflation, it is that finally, governments save money because inflation finally overshoots. Adding the last two years of high inflation to the cost from 2001 reduces the cost for both the US government and the German government to 0.6% of GDP. In other words, bond investors who hold Treasuries, Gilts or Bunds finally have to pay back to the government what they received in error over the last two decades.